Trial Balance Template

The Free Trial Balance Template is a very useful tool for controlling the monthly finances and expenses of any company.

$2.00

CompareA company’s balance sheet is essential for ensuring cost management and tracking its assets. However, its use is not limited to accounting purposes: the balance sheet concept also allows the company to have a consolidated view of its evolution over a certain period of time, since it shows all its assets and liabilities.

Liabilities, Assets, and Equity are large segments, composed of accounts that divide the characteristics of a company’s balance sheet. Therefore, these accounts vary widely by industry.

And the same terms can have different situations. Depending on the nature of the business.

The trial balance functions as a summary of the company’s balances and accounts over a given period of time, and is most often only for the organization’s internal use.

Its purpose is administrative, so it can be printed, edited and changed at any time, simply to present the overall financial health of the company.

Do companies need to do trial balances?

Although not mandatory, the trial balance is very important for preventing possible credit and debit errors in a company’s accounts. The balance values in the trial balance are fluctuating, that is, they can be changed at any time.

How is the trial balance made?

The trial balance is a financial statement that lists the debit and credit balances of an organization.

To make it, the data contained in the general ledger is used as a basis – that is, the financial movements drawn from the balance sheet and income statement accounts.

First, the balance of each account is identified according to its nature (debit or credit), so that the groups to which the account belongs (assets, liabilities or equity) are disregarded.

They are then transferred to the Trial Balance, organized in ledger format. Here the debit balance is shown on the left-hand side, while the credit balance is shown on the right-hand side.

The sum of all components, on each side, is what generates the final balances.

Advantages of the Free Balance Sheet Template

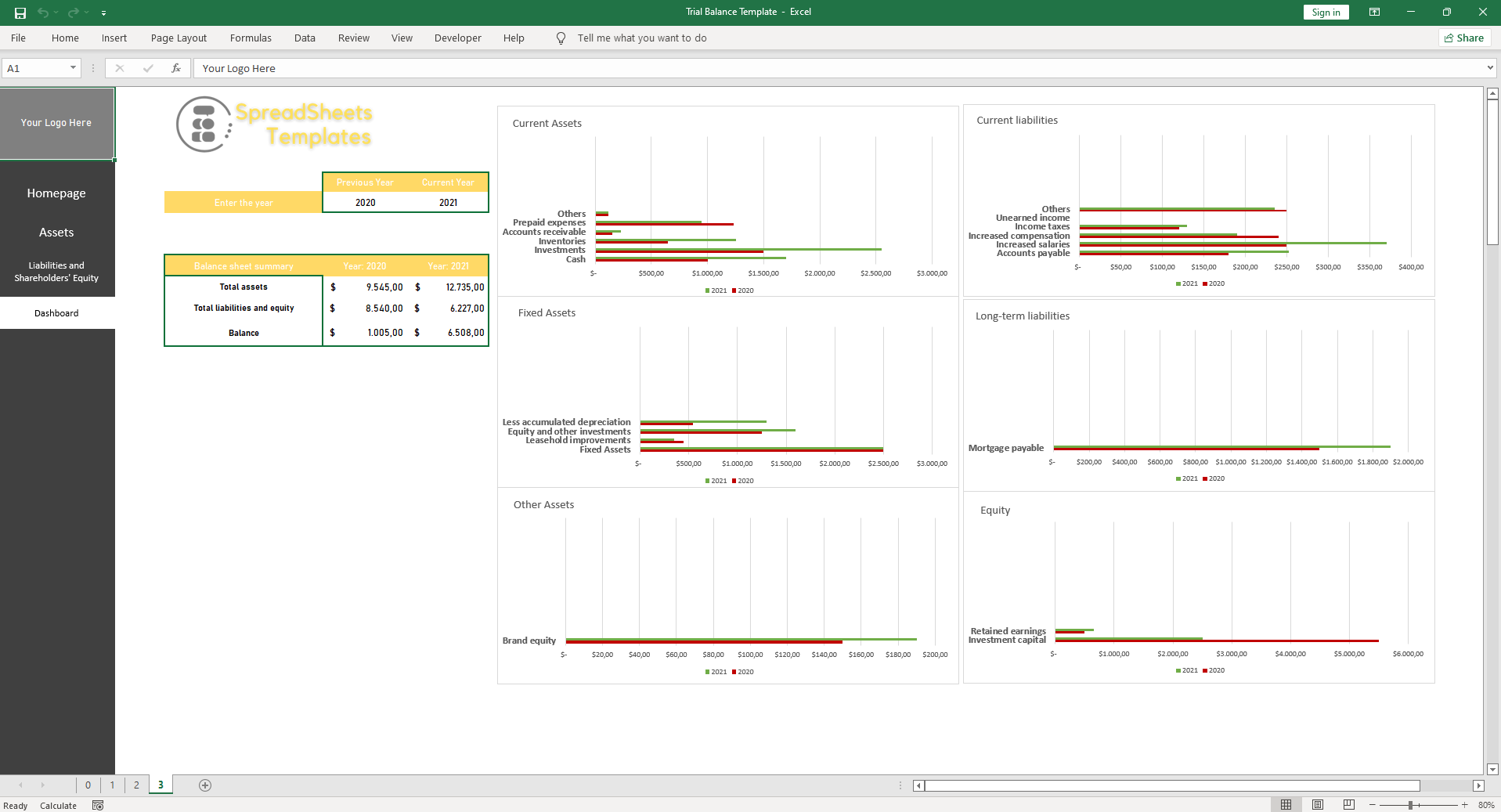

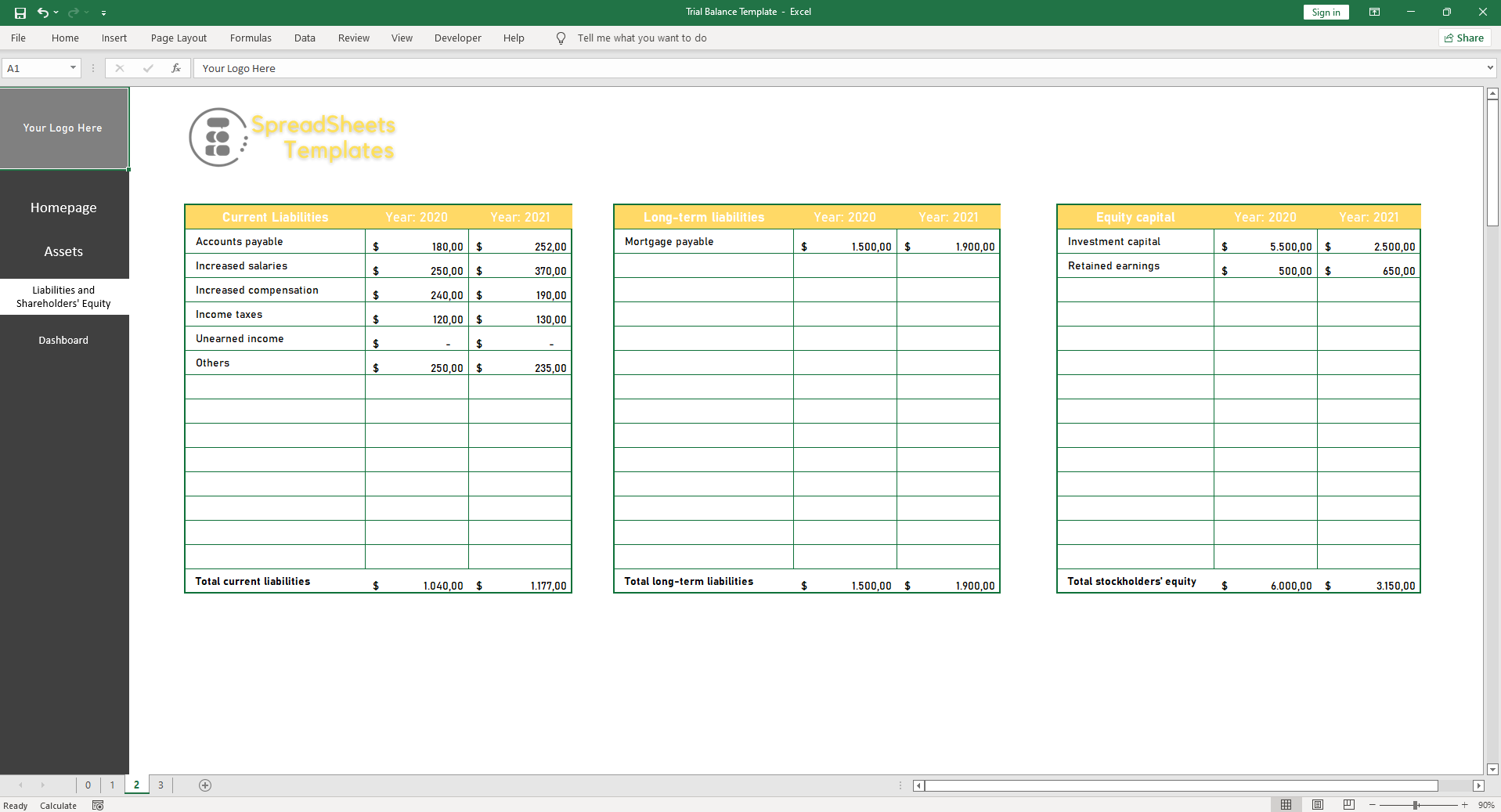

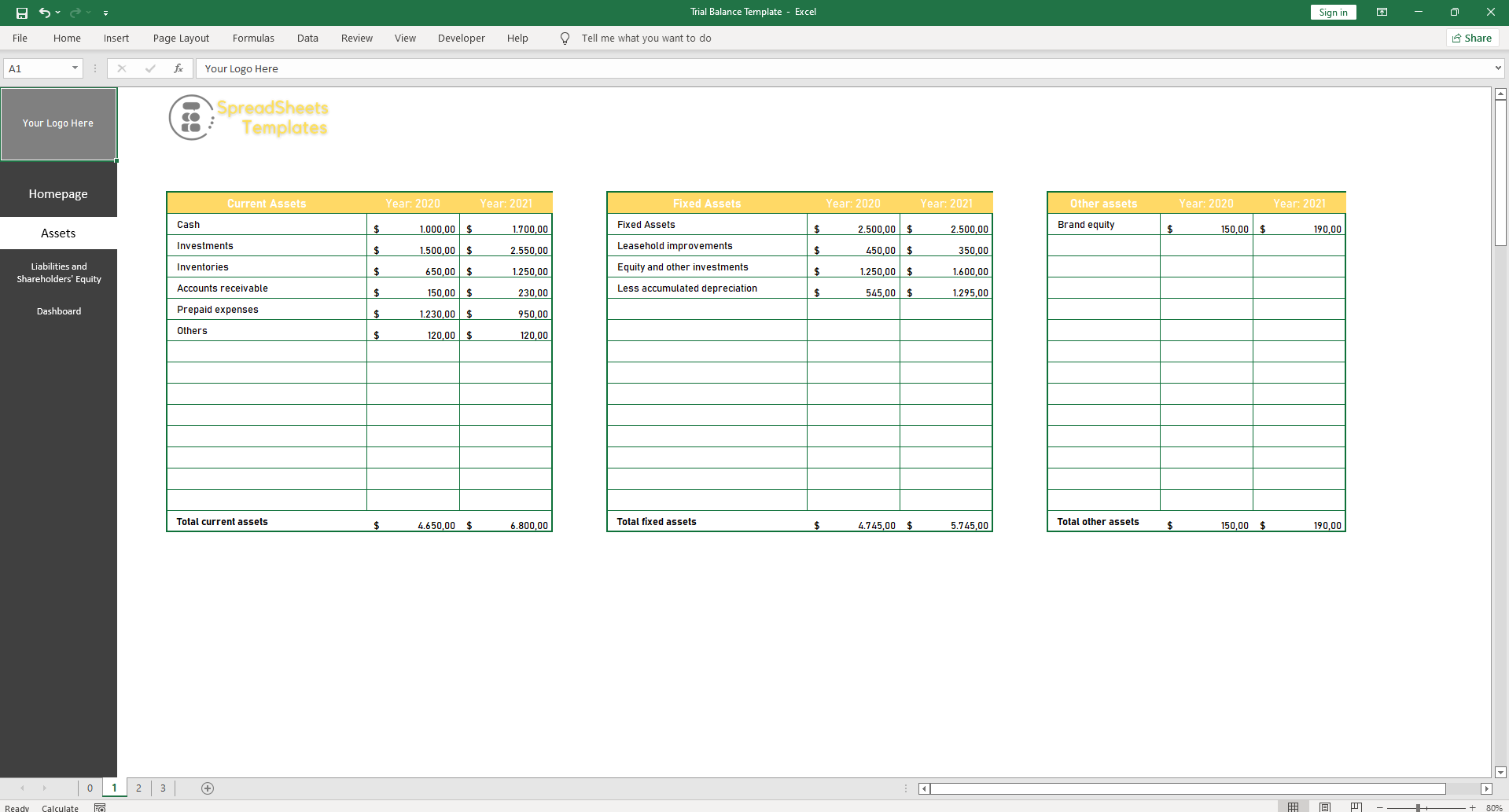

In the spreadsheet you can find three tabs that can be changed and filled out at the user’s discretion, in the three tabs are located Summary, Assets, Liabilities, and Equity. In the balance sheet summary it is possible to observe with visual indicators.

Therefore, facilitating the visualization and promoting a broader view with ease of observation.

However, it contains graphics of the assets, liabilities and equity. Besides having in the assets tab free fields to perform the actions of the assets and automatically making the calculations of current assets, fixed assets and other assets.

Based on 0 reviews

Only logged in customers who have purchased this product may leave a review.

There are no reviews yet.