Full Financial Management: Complete, simple, easy and without monthly fees

Complete Financial Management! Simple, easy to use, affordable price, no monthly fees, and approved by over 10 thousand users.

$19.99 $49.99

- Do you want to increase your profit but lack security in your Cash Flow Spreadsheet?

- Do you need to reduce your expenses but can’t figure out where to start?

- Has your company already paid interest and fines because you struggle to control Accounts Payable?

- Can’t you determine if you’ll have money available in the next 2 or 3 months for your business?

- Do you have difficulty visualizing the income vs. expenses of your company?

If you answered yes to any of the above questions, we can help you.

Financial Management Tool

Are you tired of worrying about your company’s finances? Do you want a complete, simple, and easy-to-use solution to control your finances without having to pay high monthly fees? Introducing the Financial Control Spreadsheet, the ideal solution to help you manage your finances efficiently and affordably.

COMPLETE, SIMPLE, EASY TO USE, AFFORDABLE PRICE, NO MONTHLY FEES, AND VALIDATED.

- Complete: Our financial control spreadsheet is comprehensive and covers all essential areas for managing your business finances. It includes features to record income, expenses, cash flow, accounts payable and receivable, printable reports, a dashboard with charts and indicators. With this spreadsheet, you will have a complete view of your company’s financial health.

- Simple: We understand that simplicity is key when it comes to dealing with finances. Our spreadsheet is designed to be intuitive and easy to use, even for those without finance experience. With a simple interface and clear functionalities, you can perform all necessary financial tasks without complications.

- Easy to use: There’s no need to spend hours learning how to use a new financial control tool. With our spreadsheet, you’ll be ready to start in minutes. Simply fill in the relevant information in the designated fields, and the spreadsheet will automatically calculate and provide results in a clear and organized manner.

- Affordable price: Unlike many complex and expensive financial software available in the market, our financial control spreadsheet is an affordable solution for any size of company. You don’t need to invest in expensive licenses or pay exorbitant monthly fees. Purchase the spreadsheet once and have lifetime access to its features.

- No monthly fees: We believe that financial control should not be an additional expense for your business. That’s why we offer our spreadsheet without monthly fees. You pay only once and can use it forever, with no recurring charges. This means long-term savings for your pocket.

- Validated by over 10 thousand users in more than 10 countries: The effectiveness and reliability of our financial control spreadsheet have been validated by experts and companies that have successfully used it. It has been designed based on good financial management practices to ensure the accuracy and relevance of the information provided.

Don’t waste any more time with complicated and expensive solutions for your company’s financial control. Get the complete, simple, easy-to-use, affordable, and no monthly fees Financial Control Spreadsheet right now. Take full control of your finances and make strategic decisions based on accurate information. Invest in the success of your business today!

The biggest pains for entrepreneurs are:

- Increasing Sales: Many entrepreneurs struggle to increase their sales, as there are several factors that are beyond the company’s efforts, such as market supply and demand.

- Financial Management: Financial management is one of the main challenges for entrepreneurs. Dealing with the company’s finances in an efficient and controlled manner is essential for business growth and profitability.

During the pandemic, competition and adverse situations negatively impacted the sales of many businesses. However, financial management cannot rely solely on external factors.

The meaning of Management is the administration and control of an institution, company, or social entity. Financial management encompasses processes, methods, and actions that allow a company to control, analyze, and plan its financial activities, contributing to its growth and profitability.

Professionals in the financial field work with four basic pillars in the financial control of a company:

- Planning: Establishing financial goals and objectives.

- Controlling: Monitoring and tracking the company’s revenues and expenses.

- Analyzing: Conducting financial analysis to make strategic decisions.

- Investing: Making sound and profitable investments.

Financial management is an integral part of the company’s strategic intelligence, as it involves the need to spend less than what is earned, plan revenues and expenses, make informed investments, and set aside money for emergencies.

In addition to understanding the difference between Costs and Expenses, it is important to understand and control:

- Cash Flow;

- Current Liquidity;

- Profit Margin;

- Contribution Margin;

- Break-even Point;

- Accounts Receivable;

- Accounts Payable;

- Projected Cash;

- Income vs. Expenses;

- Revenue;

- Net Profit.

Indeed, managing and controlling the finances of a company is not a simple task. Imagine trying to do all of this without having a suitable tool to assist you?

In today’s market, there are financial control systems available. However, the problem with most of them is that they are either too complex or too expensive, making it difficult for many companies to have access to a tool that helps with at least the basic financial controls.

Easy, Simple, and Complete Solution for Financial Management In order to address this pain point that affects small and medium-sized business owners, we have developed a simple, practical, and cost-effective tool to assist with financial management.

We have gathered basic financial control solutions into one tool:

Cash Flow Spreadsheet; Accounts Receivable Spreadsheet; Accounts Payable Spreadsheet; Projected Cash Flow Spreadsheet; Income vs. Expenses Spreadsheet; Customer Database Spreadsheet; Supplier Database Spreadsheet; Chart of Accounts Spreadsheet; 12 reports and a Dashboard with Charts and Indicators.

If you have made it this far, I must tell you that over 10 thousand people are already using the Financial Control Spreadsheet.

Brazil, Portugal, the United States, African countries, and Europe are also using our cash flow spreadsheet, and it is unanimous – everyone approves of it.

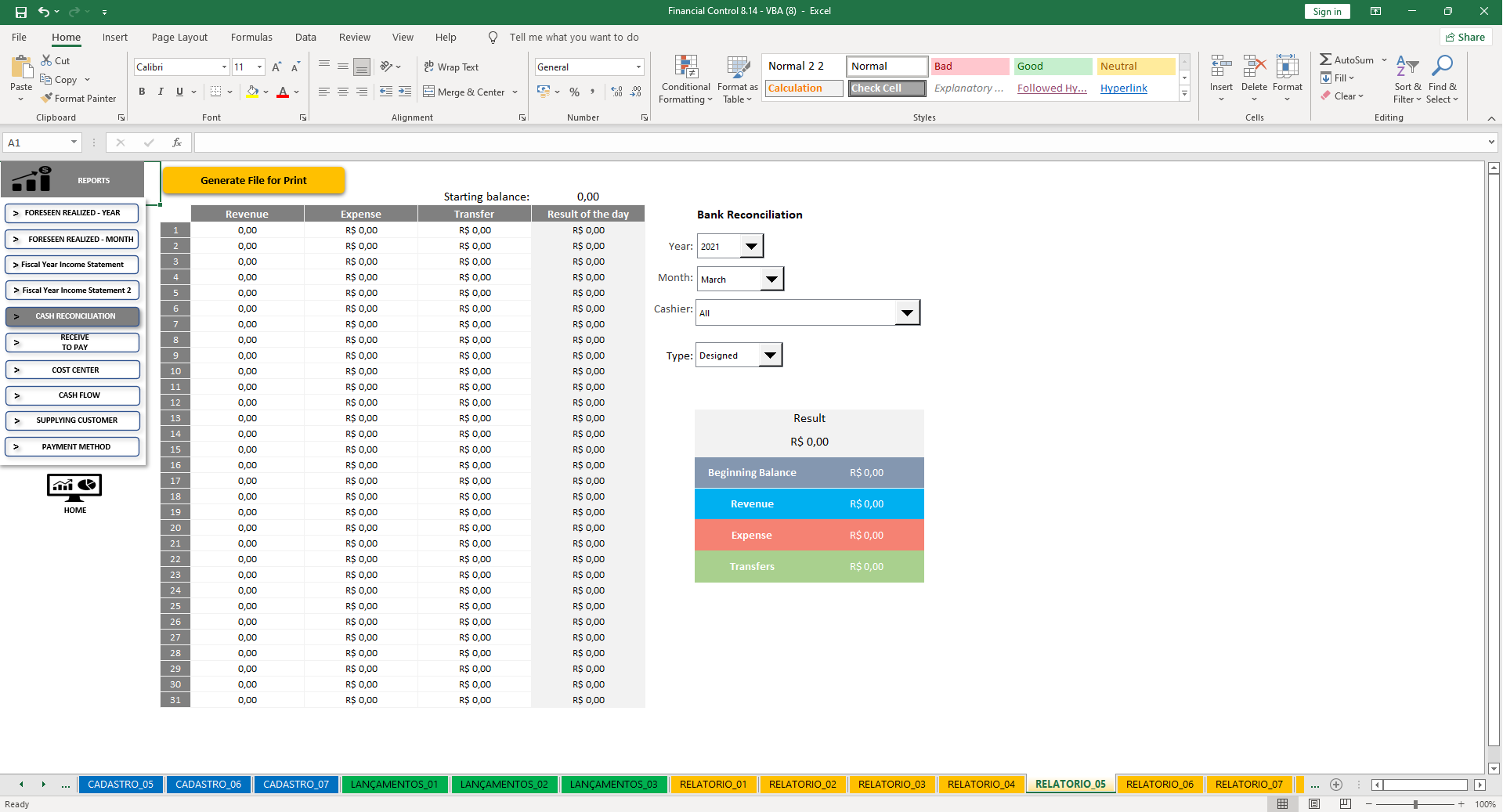

The Financial Control Spreadsheet includes the following modules:

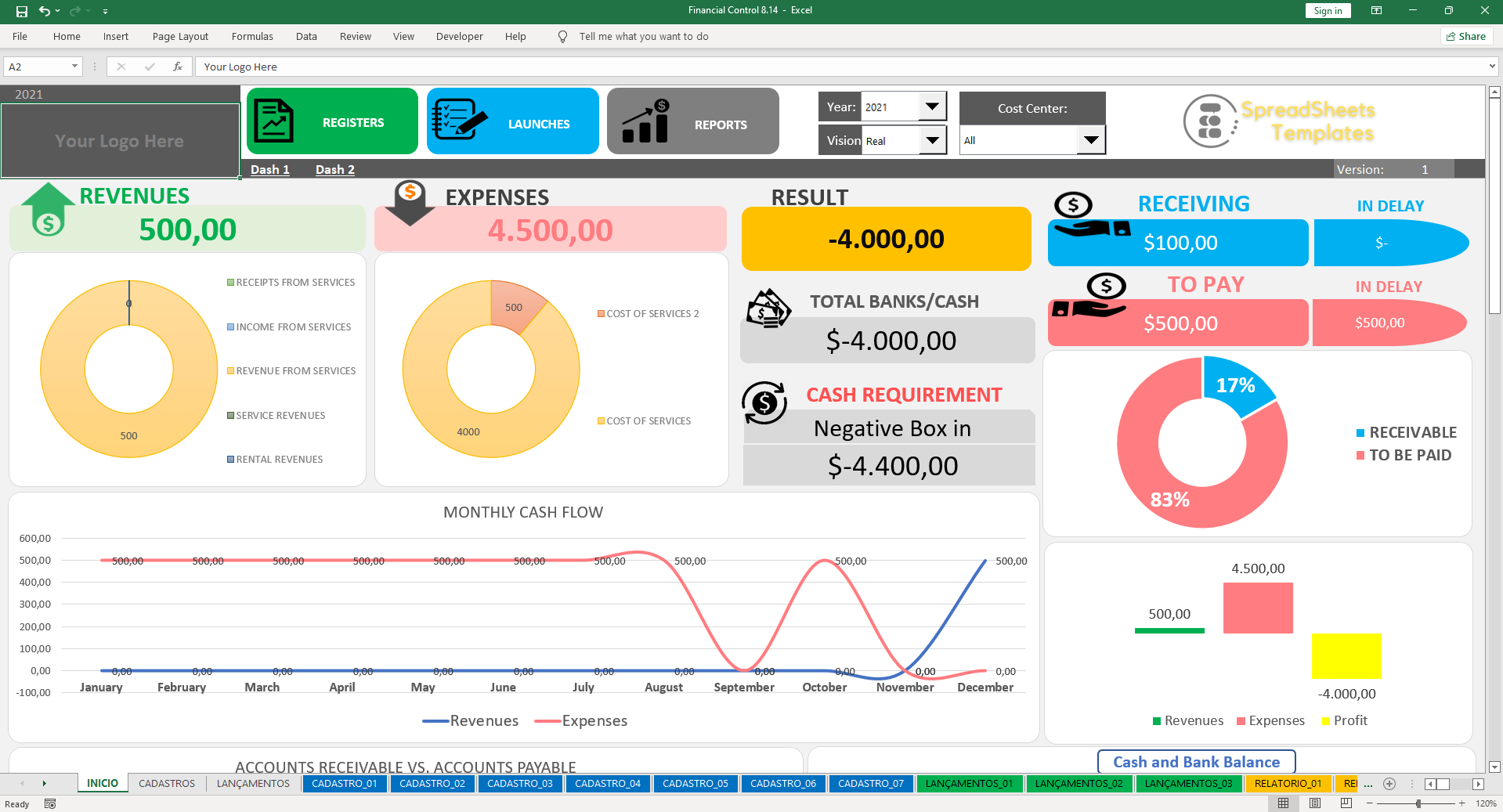

Dashboard at the beginning of the spreadsheet:

- Revenues – with options to select Year, Actual or Projected, and Cost Center;

- Expenses – with options to select Year, Actual or Projected, and Cost Center;

- Profit/Loss – with options to select Year, Actual or Projected, and Cost Center;

- Cash Requirement – with options to select Year, Actual or Projected, and Cost Center;

- Bank Account Summary – with options to select Year, Actual or Projected, and Cost Center;

- Balance of each Cash or Bank Account;

- Accounts Payable;

- Accounts Receivable;

- Notification of Overdue Balances when opening the spreadsheet;

- Accounts Receivable and Accounts Payable on a timeline.

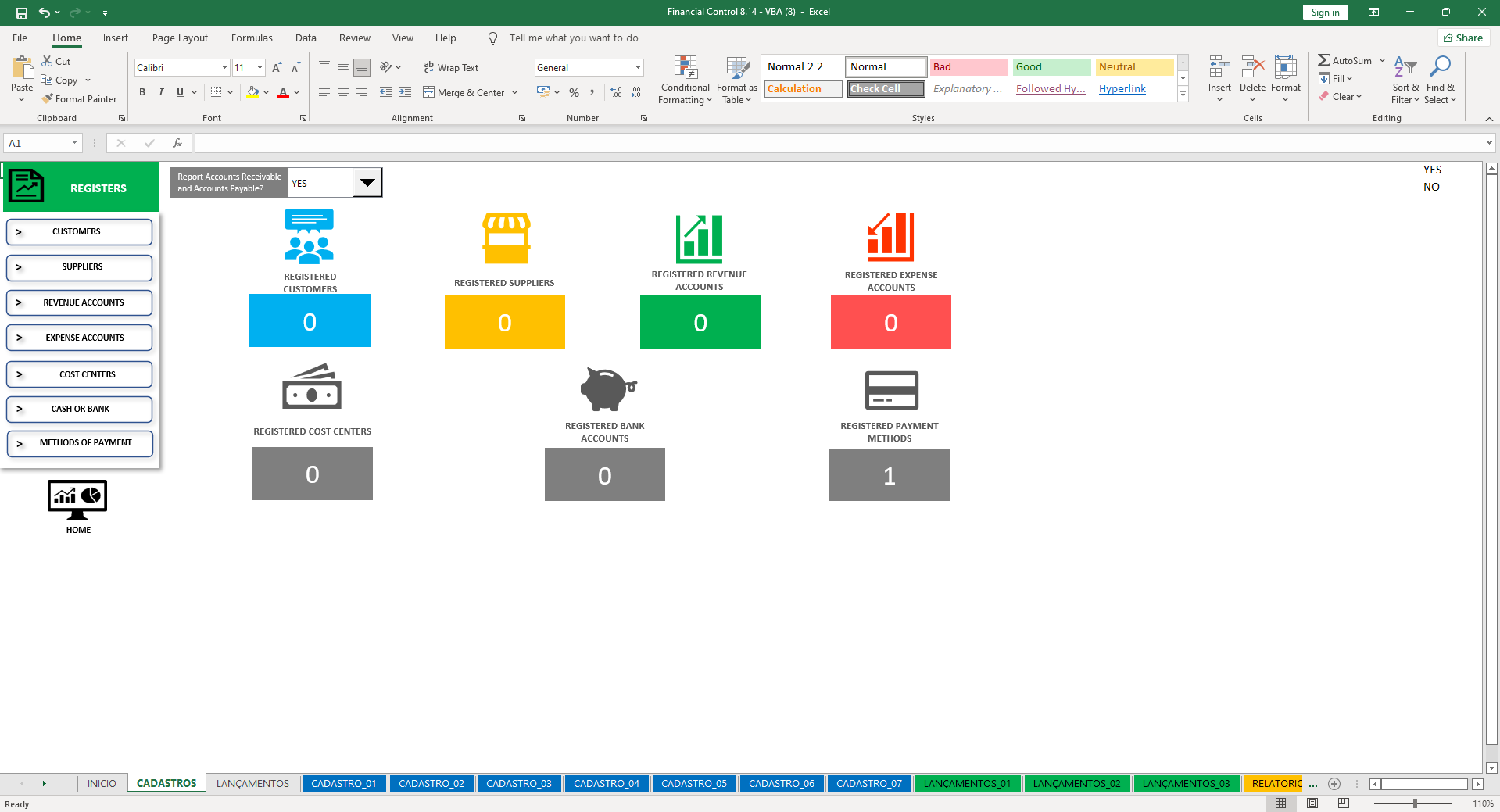

Registers:

- Customers;

- Suppliers;

- Revenue Accounts;

- Expense Accounts;

- Cost Centers;

- Cash/Bank Accounts;

- Payment Methods.

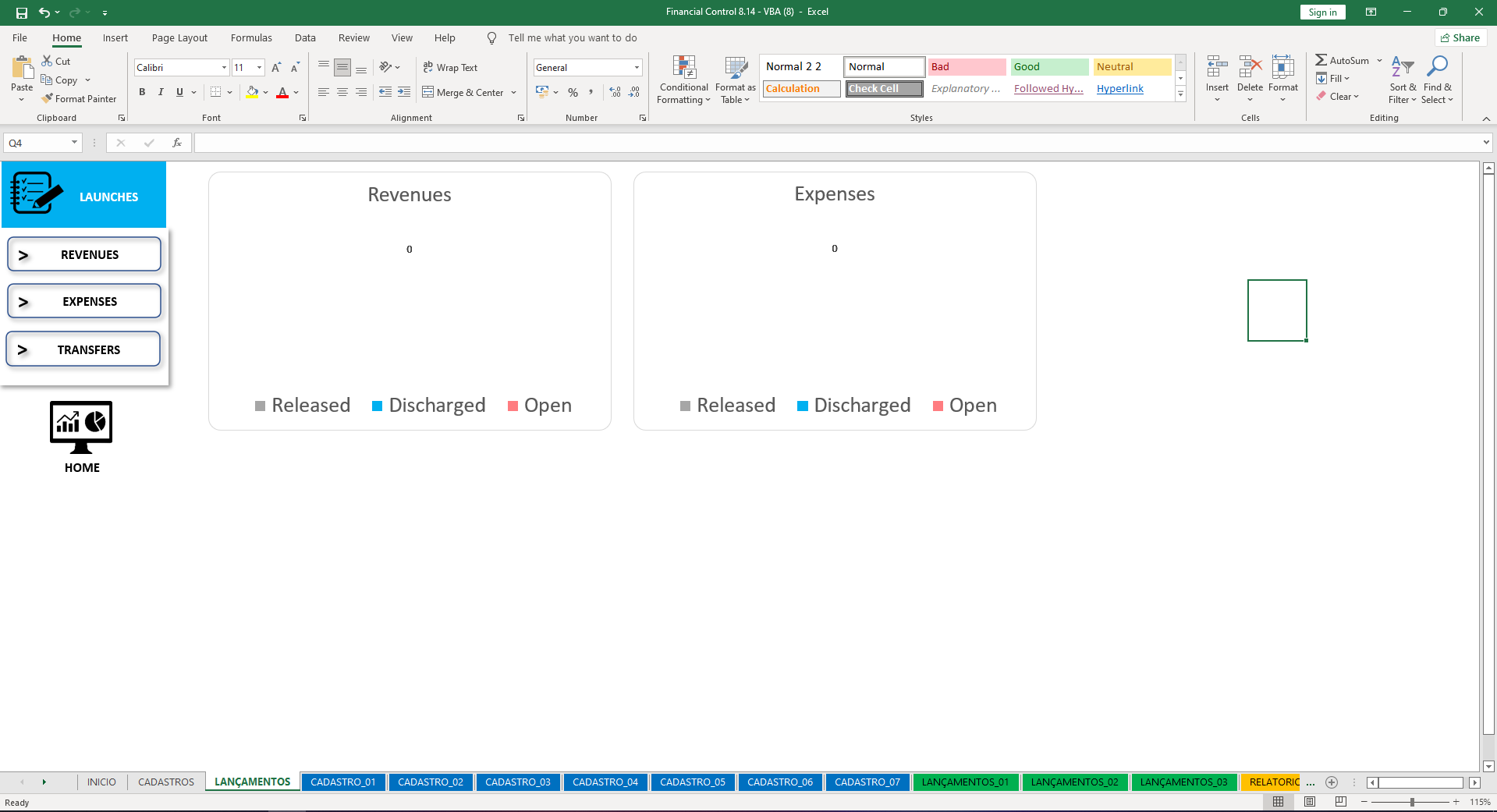

Financial Transaction Entries:

- Revenue Transactions;

- Expense Transactions;

- Cash Transactions.

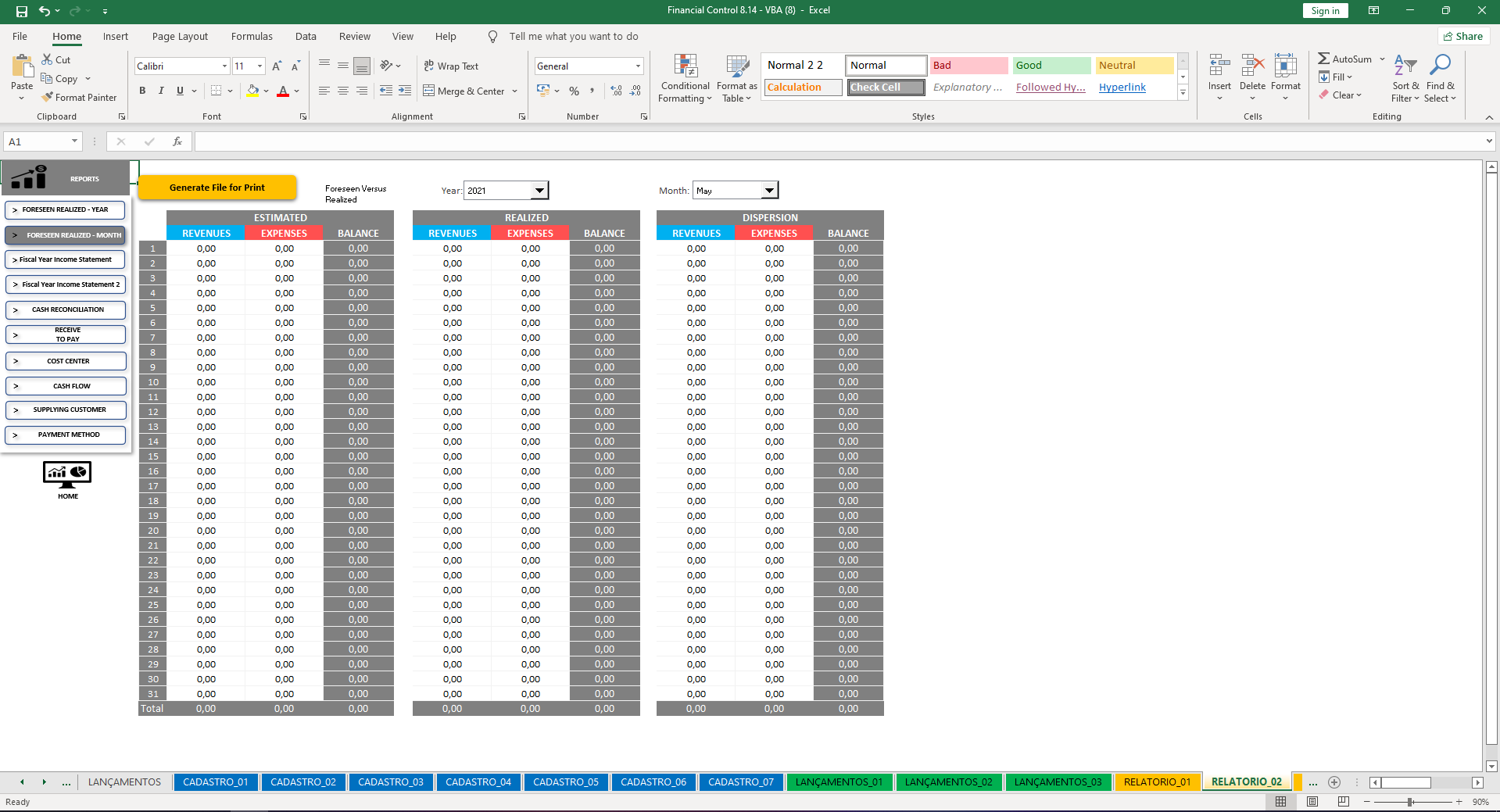

Printable Reports:

- Cash Flow – Actual or Projected;

- Expenses and Revenues – Planned vs. Actual by Year and Month;

- Expenses and Revenues – Planned vs. Actual by Month and Day;

- Income Statement (DRE) by Year, Month, and Cost Center;

- Detailed Income Statement (DRE) by Year, Month, and Cost Center;

- Detailed Income Statement (DRE) by Account Group;

- Bank Reconciliation by Month, Day, and Cost Center;

- Detailed Accounts Receivable and Payable;

- Detailed Transactions by Account Group;

- Transactions by Customer or Supplier;

- Summary of Receipts and Payments by Payment Method;

- Receipts and Payments Transactions – Paid or Outstanding.

MINIMUM COMPUTER REQUIREMENTS:

- NOT COMPATIBLE WITH MACBOOK.

- Works with Excel versions above 2010, 2013, and 2016.

- Compatible with Windows 7, 8, 8.1, and 10.

- Requires a minimum of 4GB RAM or higher.

- NOT COMPATIBLE WITH APPLE MACBOOK.

- NOT COMPATIBLE WITH TABLETS OR MOBILE PHONES.

DON’T WORK ON APPLE MACBOOK.

DOES NOT WORK ON TABLET AND NONE CELL PHONE.

FREQUENTLY ASKED QUESTIONS:

1 – Can I install on more than one computer?

Answer: Yes. You can install on as many computers as you need.

2 – Do I have to pay monthly fees?

Answer: No. The purchase is a one-time payment and there are no monthly or extra fees.

3 – Does the spreadsheet work on any version of Excel and Windows?

Answer: The spreadsheet works on all versions of Excel (2010, 2013 and above 2016) and Windows.

4 – In case of inconsistencies in the spreadsheet or execution problems, how will technical assistance be provided?

Answer: The assistance will be free of charge from Monday to Friday from 8am to 6pm, by e-mail, whatsapp and if necessary through remote access (teamviewer – by appointment).

6 – I want to make changes or modifications to the spreadsheet. Is this included in the package for free?

Answer: No. Requests for changes that tend to modify or alter the structure of the spreadsheet are not included in the assistance package. If the Client wants modifications, a quotation must be made with the development sector.

9 – If I have to format my computer, do I have to buy the program again?

Answer: No. Just save the program on a USB flash drive or download the e-mail again.

Based on 0 reviews

Only logged in customers who have purchased this product may leave a review.

There are no reviews yet.