Accounts Payable Spreadsheet Leave a comment

Streamlining Your Financial Processes

Introduction

In today’s fast-paced business world, efficient financial management is crucial for the success of any organization. One key aspect of financial management is accounts payable, which involves managing the money a business owes to its creditors or suppliers. Keeping track of accounts payable can be challenging, especially as a business grows. However, with the help of modern tools like the accounts payable spreadsheet, you can streamline your financial processes and ensure timely payments while maintaining accurate records.

Accounts Payable Spreadsheet: A Powerful Financial Tool

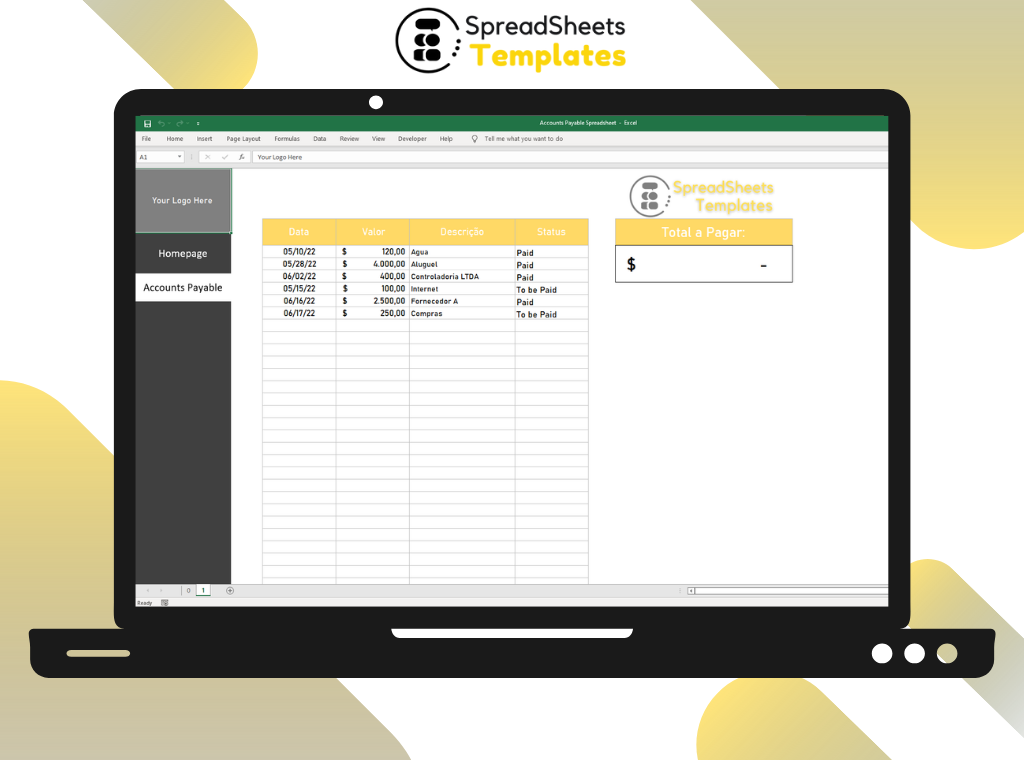

An accounts payable spreadsheet is a digital document that helps businesses manage and track their payables efficiently. It provides a centralized platform to record and monitor outstanding invoices, payment due dates, and vendor information. By leveraging the functionalities of a spreadsheet, businesses can automate calculations, generate reports, and gain valuable insights into their financial obligations.

Benefits of Using an Accounts Payable Spreadsheet

1. Enhanced Organization and Efficiency

An accounts payable spreadsheet allows businesses to maintain a systematic record of their payables. By organizing information in a structured manner, it becomes easier to track and manage payments effectively. With the ability to sort, filter, and search data, businesses can quickly locate specific invoices, monitor payment deadlines, and avoid late fees or penalties.

2. Timely Payment Management

Late payments can strain relationships with suppliers and harm your business’s reputation. An accounts payable spreadsheet enables you to schedule payments and set reminders, ensuring that your obligations are met on time. By staying on top of payment due dates, you can foster positive relationships with your suppliers and negotiate favorable terms.

3. Accurate Financial Reporting

Maintaining accurate financial records is crucial for analyzing your business’s financial health and making informed decisions. An accounts payable spreadsheet provides the necessary tools to generate comprehensive reports, such as accounts payable aging summaries, cash flow projections, and vendor analysis. These reports offer valuable insights into your payables, allowing you to identify trends, optimize cash flow, and strategize for growth.

Getting Started with an Accounts Payable Spreadsheet

Now that you understand the benefits of an accounts payable spreadsheet, let’s explore how to get started with this powerful financial tool.

Step 1: Choose the Right Spreadsheet Software

When selecting a spreadsheet software, consider popular options like Microsoft Excel, Google Sheets, or Apple Numbers. Assess your specific requirements, such as collaboration features, integrations with other tools, and ease of use. Opting for cloud-based software allows for seamless access and collaboration from multiple devices and locations.

Step 2: Design Your Spreadsheet

Designing an efficient accounts payable spreadsheet requires careful consideration of the information you need to track. Here are some essential components to include:

- Vendor Information: Create a section to record vendor details, such as name, contact information, and payment terms.

- Invoice Details: Allocate columns for invoice number, date, amount, and due date.

- Payment Status: Include a column to track payment status, indicating whether an invoice is paid, pending, or overdue.

- Payment History: Reserve a section to log payment dates and amounts, ensuring a comprehensive payment trail.

- Reporting and Analysis: Set up formulas and functions to automate calculations and generate reports, such as aging summaries and cash flow projections.

Step 3: Populate Your Spreadsheet

Start entering data into your accounts payable spreadsheet. Begin with existing outstanding invoices and vendor information. Regularly update the spreadsheet as new invoices are received and payments are made. Consistency and accuracy in data entry are vital to ensure the reliability of your financial records.

Step 4: Implement Tracking and Reminder Systems

To fully leverage your accounts payable spreadsheet, consider integrating tracking and reminder systems. Use conditional formatting to highlight approaching due dates or overdue invoices. Set up automatic email reminders to notify responsible parties of upcoming payment deadlines. These measures will help you maintain a proactive approach to managing your payables.

Frequently Asked Questions (FAQs)

1. What is the purpose of an accounts payable spreadsheet?

An accounts payable spreadsheet serves as a centralized tool to track and manage the money a business owes to its creditors or suppliers. It helps businesses organize payables, monitor payment due dates, and maintain accurate financial records.

2. How can an accounts payable spreadsheet benefit my business?

Using an accounts payable spreadsheet can enhance organization and efficiency, ensure timely payment management, and enable accurate financial reporting. It helps you streamline your financial processes, maintain positive relationships with suppliers, and make informed decisions based on comprehensive data.

3. Which spreadsheet software is best for creating an accounts payable spreadsheet?

Popular spreadsheet software options like Microsoft Excel, Google Sheets, and Apple Numbers are suitable for creating an accounts payable spreadsheet. Choose software that aligns with your business needs, considering factors such as collaboration features, integrations, and ease of use.

4. How often should I update my accounts payable spreadsheet?

It is essential to update your accounts payable spreadsheet regularly to maintain accurate records. Update the spreadsheet each time you receive a new invoice or make a payment. Consistency in data entry ensures the reliability of your financial information.

5. Can I automate calculations and generate reports with an accounts payable spreadsheet?

Yes, an accounts payable spreadsheet allows you to automate calculations and generate reports. By setting up formulas and functions, you can streamline calculations and obtain valuable insights into your payables. Generate reports such as aging summaries, cash flow projections, and vendor analyses to support financial analysis and decision-making.

6. How can I ensure data accuracy in my accounts payable spreadsheet?

To ensure data accuracy, exercise diligence when entering information into your accounts payable spreadsheet. Double-check invoice details, payment dates, and amounts before recording them. Regularly reconcile your spreadsheet with bank statements to identify and rectify any discrepancies.

Conclusion

Efficient management of accounts payable is crucial for the financial well-being of your business. By leveraging the power of an accounts payable spreadsheet, you can streamline your payables processes, ensure timely payments, and maintain accurate financial records. With the ability to automate calculations and generate insightful reports, this versatile tool empowers businesses to make informed decisions and achieve financial success.

So, why wait? Embrace the benefits of an accounts payable spreadsheet and take control of your financial obligations today!