Summarized Cash Flow Sheet Leave a comment

Managing Your Finances Made Easy

Introduction

Welcome to this comprehensive guide on managing your finances using a Summarized Cash Flow Sheet. In today’s fast-paced world, it’s essential to have a clear understanding of your financial situation. A Summarized Cash Flow Sheet provides a concise overview of your income, expenses, and savings, enabling you to make informed financial decisions. In this article, we will explore the benefits of using a Summarized Cash Flow Sheet and provide you with practical tips to effectively manage your finances.

Table of Contents

- Understanding the Importance of Financial Management

- What is a Summarized Cash Flow Sheet?

- The Components of a Summarized Cash Flow Sheet

- Creating Your Own Summarized Cash Flow Sheet

- Analyzing Your Cash Flow

- Strategies to Improve Your Cash Flow

- Monitoring Your Progress

- Common Mistakes to Avoid

- Frequently Asked Questions

- What is the purpose of a Summarized Cash Flow Sheet?

- How often should I update my Summarized Cash Flow Sheet?

- Can I use software to create and manage my cash flow sheet?

- How can a Summarized Cash Flow Sheet help with financial goal setting?

- Should I include all my expenses in the cash flow sheet?

- Is it necessary to consult a financial advisor when managing my finances?

- Conclusion

Understanding the Importance of Financial Management

Effective financial management is the key to achieving long-term financial stability and success. By gaining a clear understanding of your income, expenses, and savings, you can make informed decisions about spending, saving, and investing. This knowledge empowers you to plan for the future, minimize debt, and build a strong financial foundation.

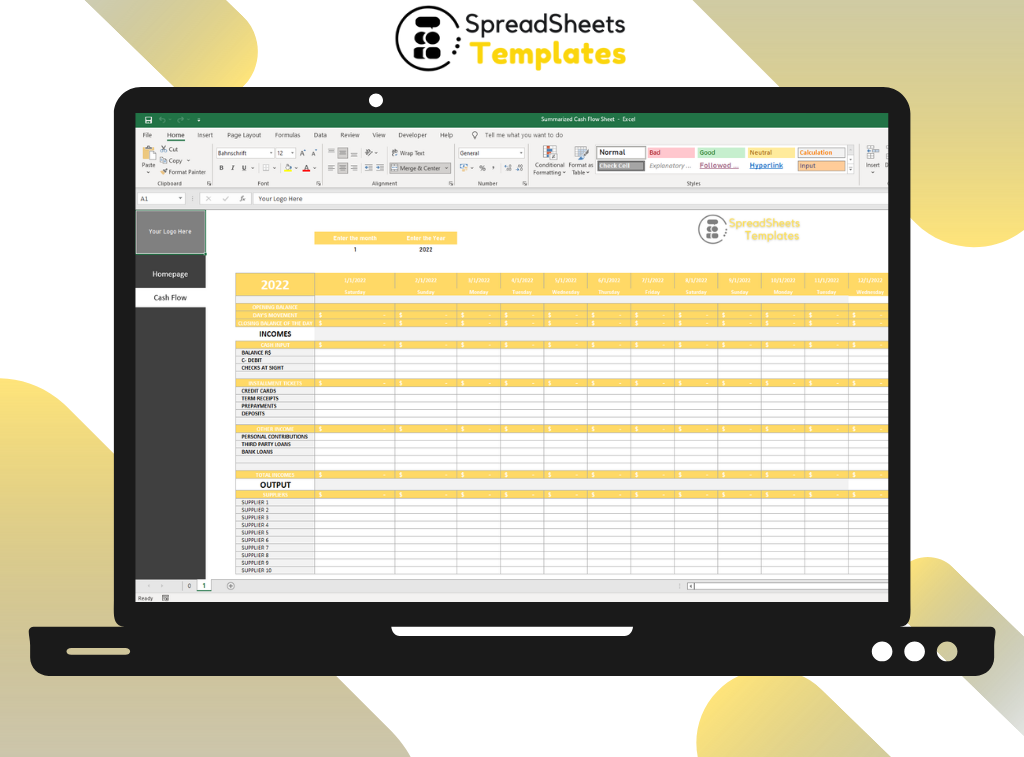

What is a Summarized Cash Flow Sheet?

A Summarized Cash Flow Sheet is a financial tool that provides an overview of your cash inflows and outflows over a specific period. It helps you understand how much money is coming in and going out, allowing you to track your spending patterns and identify areas where you can save or invest more effectively.

The Components of a Summarized Cash Flow Sheet

A Summarized Cash Flow Sheet typically consists of the following components:

- Income: This section includes all sources of income, such as salary, rental income, investments, or side business earnings.

- Expenses: Here, you list all your expenses, including fixed expenses (rent, utilities, insurance) and variable expenses (groceries, entertainment, transportation).

- Savings: This component highlights your savings, which can include contributions to retirement accounts, emergency funds, or other investment vehicles.

- Net Cash Flow: The net cash flow is calculated by subtracting total expenses from total income. A positive cash flow indicates a surplus, while a negative cash flow signifies a deficit.

Creating Your Own Summarized Cash Flow Sheet

Now that you understand the importance of a Summarized Cash Flow Sheet, it’s time to create your own. Here’s a step-by-step guide to help you get started:

- Set a Time Frame: Decide on the period you want to track your cash flow, whether it’s monthly, quarterly, or annually.

- Gather Financial Information: Collect all your financial statements, including bank statements, pay stubs, bills, and receipts.

- Categorize Income and Expenses: Separate your income and expenses into appropriate categories, such as salary, investment income, rent, groceries, utilities, etc.

- Calculate Totals: Sum up the totals for each category to determine your overall income and expenses.

- Calculate Net Cash Flow: Subtract your total expenses from your total income to calculate your net cash flow.

- Update Regularly: Make it a habit to update your Summarized Cash Flow Sheet regularly to ensure it remains accurate and relevant.

Analyzing Your Cash Flow

Once you have created your Summarized Cash Flow Sheet, it’s time to analyze the data. Here are a few key points to consider:

- Identify Spending Patterns: Review your expenses to identify any recurring patterns or trends. This will help you identify areas where you can potentially cut back on unnecessary spending.

- Evaluate Income Sources: Assess your various income sources and determine if there are opportunities to increase your earnings. This could involve exploring side hustles, investing in income-generating assets, or negotiating a raise at work.

- Assess Debt-to-Income Ratio: Calculate your debt-to-income ratio by dividing your total debt by your total income. This will give you an indication of your ability to manage and repay your debts.

Strategies to Improve Your Cash Flow

Managing your cash flow effectively is crucial for maintaining financial stability. Here are some strategies to help you improve your cash flow:

- Reduce Discretionary Spending: Cut back on non-essential expenses such as dining out, entertainment, and impulse purchases. This will free up more money to allocate towards savings or debt repayment.

- Increase Income Streams: Explore opportunities to boost your income by taking on a part-time job, freelancing, or starting a side business. Diversifying your income sources can significantly improve your cash flow.

- Negotiate Bills and Contracts: Contact service providers and negotiate better terms or rates for your bills and contracts. This could include your internet, cable, insurance, or even rent.

- Minimize Debt: Focus on paying off high-interest debts first while making minimum payments on others. As you reduce your debt, you’ll have more disposable income to allocate towards savings and investments.

Monitoring Your Progress

Regularly monitoring your cash flow is crucial to staying on track with your financial goals. Here’s how you can effectively monitor your progress:

- Review Monthly Reports: Analyze your Summarized Cash Flow Sheet on a monthly basis to identify any areas that require attention. Look for opportunities to optimize your income and expenses further.

- Track Changes Over Time: Compare your cash flow statements from different time periods to gauge your progress. This will help you determine if your financial strategies are working effectively or if adjustments are needed.

- Adjust Your Budget: If you notice any significant discrepancies or changes in your cash flow, revise your budget accordingly. Adapt to new circumstances and make the necessary adjustments to ensure your financial goals are still attainable.

Common Mistakes to Avoid

While using a Summarized Cash Flow Sheet can greatly benefit your financial management, it’s essential to avoid common pitfalls. Here are a few mistakes to steer clear of:

- Neglecting Small Expenses: Small expenses can quickly add up and impact your cash flow. Be mindful of your spending, even on seemingly insignificant items.

- Failing to Include Irregular Expenses: Don’t forget to account for irregular expenses such as car repairs, medical bills, or annual subscriptions. Set aside a portion of your income for these unexpected costs.

- Overlooking the Importance of Emergency Funds: It’s crucial to have an emergency fund to cover unforeseen expenses or job loss. Prioritize saving for emergencies to safeguard your financial stability.

- Relying Solely on Credit: Avoid relying too heavily on credit cards or loans to cover expenses. High-interest rates and excessive borrowing can lead to long-term financial strain.

Frequently Asked Questions

Q: What is the purpose of a Summarized Cash Flow Sheet?

A: A Summarized Cash Flow Sheet helps individuals gain a clear understanding of their income, expenses, and savings. It enables effective financial management and helps identify areas where adjustments can be made to improve financial stability.

Q: How often should I update my Summarized Cash Flow Sheet?

A: It is recommended to update your Summarized Cash Flow Sheet on a monthly basis. This allows you to track your progress, identify any changes, and make adjustments accordingly.

Q: Can I use software to create and manage my cash flow sheet?

A: Yes, there are several financial management software options available that can help you create and manage your Summarized Cash Flow Sheet. These software solutions offer additional features such as automated calculations and data synchronization.

Q: How can a Summarized Cash Flow Sheet help with financial goal setting?

A: A Summarized Cash Flow Sheet provides a clear picture of your financial situation, making it easier to set realistic financial goals. By analyzing your cash flow, you can identify areas where you can save or invest more effectively, bringing you closer to achieving your goals.

Q: Should I include all my expenses in the cash flow sheet?

A: It’s important to include all your expenses in the cash flow sheet to get an accurate overview of your financial situation. This includes both fixed expenses (such as rent, utilities) and variable expenses (such as groceries, entertainment). Don’t overlook any expenses, no matter how small they may seem.

Q: Is it necessary to consult a financial advisor when managing my finances?

A: While not mandatory, consulting a financial advisor can provide valuable insights and guidance tailored to your specific financial situation. They can help you create a comprehensive financial plan, provide investment advice, and offer strategies to optimize your cash flow.

Conclusion

In conclusion, a Summarized Cash Flow Sheet is an invaluable tool for managing your finances effectively. By creating and regularly updating your cash flow sheet, you gain a clear understanding of your income, expenses, and savings, enabling you to make informed financial decisions. Implement the strategies outlined in this article to improve your cash flow, monitor your progress, and work towards achieving your financial goals.