Cash Flow Template Spreadsheet Leave a comment

Managing Your Finances Made Easy

Introduction

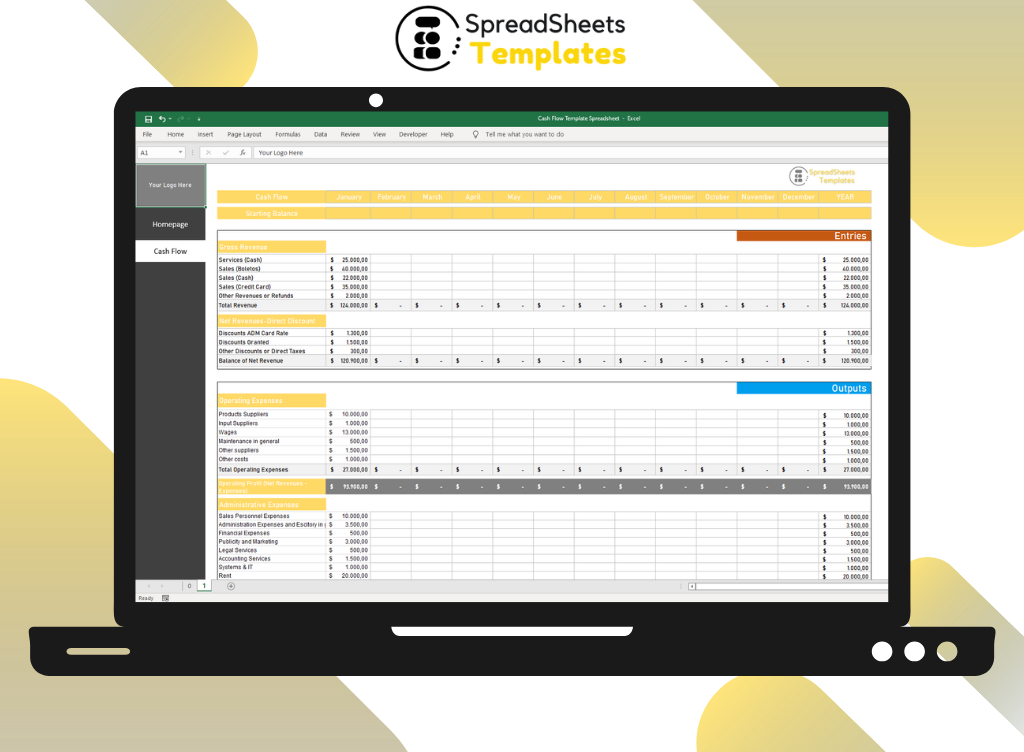

In today’s fast-paced world, managing personal or business finances effectively is crucial for financial stability and success. One tool that can greatly assist you in this endeavor is a cash flow template spreadsheet. A cash flow template spreadsheet provides a clear overview of your income and expenses, enabling you to track and analyze your financial activities comprehensively.

What is a Cash Flow Template Spreadsheet?

A cash flow template spreadsheet is a dynamic tool that helps individuals and businesses organize and monitor their cash flow. It acts as a virtual ledger, documenting all financial transactions and categorizing them into income and expenses. By using a cash flow template spreadsheet, you gain visibility into your financial health, enabling you to make informed decisions and plan for the future.

The Benefits of Using a Cash Flow Template Spreadsheet

- Improved Financial Awareness: A cash flow template spreadsheet enhances your financial awareness by providing a detailed breakdown of your income sources and expenses. You can easily identify areas where you can cut costs or increase revenue, leading to better financial management.

- Effective Budgeting: With a cash flow template spreadsheet, you can create and maintain a budget effortlessly. It allows you to allocate funds to various categories, such as rent, utilities, groceries, and savings, ensuring that you stay within your financial limits.

- Track Financial Goals: Whether you are saving for a down payment on a house, planning a dream vacation, or aiming for early retirement, a cash flow template spreadsheet helps you track your progress towards your financial goals. You can set specific targets and monitor your actual income and expenses against them.

- Identify Cash Flow Patterns: By analyzing the data in your cash flow template spreadsheet, you can identify patterns and trends in your cash flow. This information enables you to predict future income and expenses accurately, allowing for better financial forecasting and decision-making.

- Prepare for Unexpected Expenses: Life is full of surprises, and financial emergencies can happen when we least expect them. A cash flow template spreadsheet helps you build an emergency fund by identifying areas where you can save money and allocate funds towards unforeseen expenses.

- Monitor Business Performance: For business owners, a cash flow template spreadsheet is an invaluable tool for monitoring business performance. It allows you to track revenue, expenses, and profit margins, enabling you to make strategic decisions that drive growth and profitability.

Setting Up Your Cash Flow Template Spreadsheet

Creating a cash flow template spreadsheet may seem daunting, but with the right approach, it can be a straightforward process. Follow these steps to set up your cash flow template spreadsheet:

Step 1: Determine Your Income Sources

List all the sources of income you receive regularly. This can include salary, rental income, dividends, or any other form of revenue. Ensure that you capture both fixed and variable income sources.

Step 2: Identify Your Fixed Expenses

Next, identify your fixed expenses. These are recurring expenses that remain relatively constant month after month, such as rent or mortgage payments, loan installments, insurance premiums, and subscription fees.

Step 3: Track Variable Expenses

Variable expenses are costs that fluctuate from month to month. Examples include groceries, entertainment, transportation, and utility bills. Monitor these expenses carefully and update your cash flow template spreadsheet accordingly.

Step 4: Calculate Net Cash Flow

To determine your net cash flow, subtract your total expenses from your total income. A positive net cash flow indicates a surplus, while a negative net cash flow indicates a deficit. Aim to achieve a positive net cash flow to maintain a healthy financial position.

Step 5: Regularly Update and Analyze

To derive the maximum benefit from your cash flow template spreadsheet, make it a habit to update it regularly. Review your financial data, analyze trends, and make adjustments as necessary. This will enable you to stay on top of your finances and make informed decisions.

FAQs about Cash Flow Template Spreadsheets

1. What makes a cash flow template spreadsheet different from other financial tools?

A cash flow template spreadsheet is specifically designed to track cash inflows and outflows, providing a comprehensive overview of your financial situation. Unlike generic financial tools, it allows for easy customization and focuses solely on cash flow management.

2. Can I use a cash flow template spreadsheet for personal and business finances simultaneously?

Absolutely! A cash flow template spreadsheet is versatile and can be used for both personal and business finances. Simply create separate sheets or sections to differentiate between the two.

3. Are there ready-made cash flow template spreadsheets available?

Yes, there are numerous pre-designed cash flow template spreadsheets available online. These templates often come with built-in formulas and predefined categories, making it even easier for you to get started.

4. How frequently should I update my cash flow template spreadsheet?

It is recommended to update your cash flow template spreadsheet at least once a week to ensure accurate and up-to-date financial information. However, if you have a more dynamic cash flow, such as in a business setting, updating it more frequently, such as daily or bi-weekly, may be necessary.

5. Can I use a cash flow template spreadsheet to create financial projections?

Certainly! A cash flow template spreadsheet is an excellent tool for creating financial projections. By analyzing past cash flow patterns, you can make informed estimates and forecasts for the future.

6. Are there any alternatives to using a cash flow template spreadsheet?

While a cash flow template spreadsheet is highly effective, some individuals and businesses may prefer using financial management software or mobile apps. These tools often provide additional features such as automatic synchronization with bank accounts and real-time tracking.

Conclusion

Managing your finances doesn’t have to be a daunting task. With the help of a cash flow template spreadsheet, you can gain control over your cash flow, make informed financial decisions, and work towards your financial goals. By accurately tracking your income and expenses, you’ll be able to identify areas for improvement, save money, and plan for a secure financial future.

So why wait? Start using a cash flow template spreadsheet today and experience the peace of mind that comes with knowing your finances are in order.