Personal Net Worth Calculation Worksheet Leave a comment

Assessing Your Financial Standing

Introduction

In today’s fast-paced world, it’s crucial to have a clear understanding of your financial situation. Knowing your personal net worth is a fundamental step towards financial success. This article will guide you through the process of calculating your personal net worth using a helpful tool called the Personal Net Worth Calculation Worksheet. By following this step-by-step guide, you’ll gain insight into your overall financial health and be better equipped to make informed decisions about your financial future.

What Is Personal Net Worth?

Before we dive into the details of the Personal Net Worth Calculation Worksheet, let’s first define what personal net worth means. Your personal net worth represents the total value of your assets minus your liabilities. In simpler terms, it reflects your financial standing by taking into account what you own and what you owe.

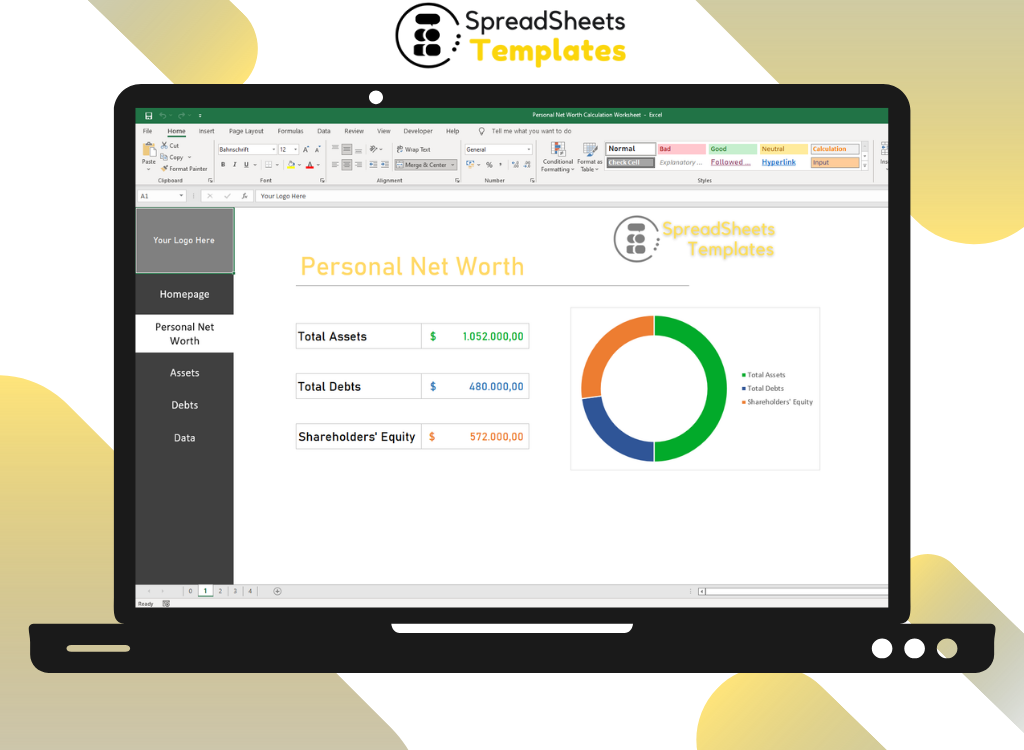

Personal Net Worth Calculation Worksheet: A Comprehensive Overview

1. Understanding the Purpose of the Worksheet

The Personal Net Worth Calculation Worksheet is a valuable tool designed to help individuals assess their financial health. It allows you to organize and evaluate your assets and liabilities, giving you a clear snapshot of your net worth. By filling out this worksheet, you’ll be able to track your progress over time and identify areas where you can improve your financial well-being.

2. Gathering Your Financial Information

To begin using the Personal Net Worth Calculation Worksheet effectively, gather all the necessary financial information. This includes details about your assets such as cash, investments, real estate, vehicles, and personal belongings. Additionally, collect information about your liabilities, such as mortgages, loans, credit card debt, and outstanding bills.

3. Completing the Worksheet

The Personal Net Worth Calculation Worksheet consists of several sections, each focusing on different aspects of your financial life. Let’s explore the key sections and how to fill them out accurately:

Personal Assets

In this section, list all your assets and their corresponding values. Include your savings, investments, retirement accounts, real estate, vehicles, and any other valuable possessions. Assign realistic and current values to ensure accurate calculations.

Liabilities

In the liabilities section, list all your debts and obligations. Include mortgage balances, outstanding loans, credit card debt, student loans, and any other financial obligations. Remember to provide the most up-to-date information to obtain an accurate representation of your liabilities.

Net Worth Calculation

The net worth calculation section is where the magic happens. By subtracting your total liabilities from your total assets, you’ll arrive at your personal net worth. This figure serves as an indicator of your financial health and provides valuable insights into your overall financial well-being.

4. Analyzing Your Personal Net Worth

Once you have completed the Personal Net Worth Calculation Worksheet, take a moment to analyze your results. Understanding the significance of your net worth requires a holistic view. Here are a few key points to consider:

- Positive Net Worth: If your assets exceed your liabilities, you have a positive net worth. This indicates that you have more resources available than you owe, suggesting a healthy financial standing.

- Negative Net Worth: Conversely, a negative net worth signifies that your liabilities outweigh your assets. This can indicate a need to reassess your financial strategies and work towards reducing your debt.

Personal Net Worth Calculation Worksheet: Frequently Asked Questions (FAQs)

1. What if I don’t have all the information required for the worksheet?

If you don’t have all the necessary financial information readily available, take the time to gather it. Accurate data is crucial for an effective assessment of your personal net worth.

2. How often should I update my personal net worth calculation?

It’s advisable to update your personal net worth calculation at least once a year. However, significant life events, such as a change in employment or major purchases, may prompt more frequent updates.

3. Is personal net worth the only measure of financial success?

While personal net worth is a valuable indicator of your financial health, it’s not the only measure of success. Factors such as income, savings rate, and financial goals should also be considered in assessing your overall financial well-being.

4. Can my personal net worth change over time?

Absolutely! Your personal net worth is dynamic and can fluctuate based on various factors, including changes in the value of your assets, fluctuations in the stock market, and adjustments to your liabilities.

5. What can I do to improve my personal net worth?

To improve your personal net worth, focus on increasing your assets and reducing your liabilities. This can be achieved through strategies such as saving more, investing wisely, paying down debt, and controlling expenses.

6. Should I seek professional help to assess my personal net worth?

If you find the process overwhelming or require expert guidance, it’s advisable to consult with a financial advisor or planner. They can provide personalized advice tailored to your specific financial situation and goals.

Conclusion

Assessing your personal net worth is a vital step towards achieving financial stability and success. By utilizing the Personal Net Worth Calculation Worksheet and following the steps outlined in this article, you can gain valuable insights into your financial health. Remember, it’s not just about the numbers; it’s about taking control of your financial future and making informed decisions that align with your goals. Start today, and pave the way for a brighter financial tomorrow.