Fiscal Year Income Statement Template Leave a comment

A Comprehensive Guide for Financial Reporting

Introduction

In the world of finance, accurate and detailed financial reporting is essential for businesses of all sizes. One crucial component of financial reporting is the fiscal year income statement. This document provides a comprehensive overview of a company’s financial performance during a specific fiscal year. In this article, we will delve into the details of the fiscal year income statement template, exploring its importance, structure, and how to create one effectively.

Understanding the Fiscal Year Income Statement Template

The fiscal year income statement template, also known as the profit and loss statement or statement of earnings, is a financial statement that presents the revenues, expenses, and resulting net income or loss of a company for a specific fiscal year. It provides valuable insights into a company’s profitability, operational efficiency, and financial health.

The Significance of a Well-Prepared Income Statement

A well-prepared fiscal year income statement offers numerous benefits to businesses and stakeholders alike. Here are some of the key advantages:

- Financial Performance Evaluation: The income statement allows businesses to evaluate their financial performance over a specific period, helping them identify areas of success and areas that require improvement.

- Decision-Making Tool: Investors, lenders, and other stakeholders rely on the income statement to make informed decisions regarding their involvement with a company. It provides insights into a company’s profitability and financial viability.

- Comparative Analysis: By comparing income statements from different fiscal years, businesses can track their progress and identify trends in revenue growth, expense management, and overall profitability.

- Compliance and Legal Requirements: Proper financial reporting, including the income statement, ensures compliance with accounting standards and regulatory requirements.

Components of a Fiscal Year Income Statement Template

A typical fiscal year income statement template consists of several sections, each providing valuable information about a company’s financial performance. Let’s explore these components in detail:

Revenue

Revenue represents the total income generated from the sale of goods or services. It includes sales revenue, fees, royalties, and any other sources of income directly related to the company’s core operations.

Cost of Goods Sold (COGS)

COGS refers to the direct costs associated with producing or delivering goods or services. This includes raw materials, direct labor costs, and manufacturing overhead. Subtracting COGS from revenue yields gross profit.

Operating Expenses

Operating expenses encompass various costs incurred during regular business operations. This includes expenses such as rent, utilities, salaries, marketing expenses, and administrative costs. Operating expenses are subtracted from gross profit to calculate operating income.

Non-Operating Income and Expenses

Non-operating income and expenses include gains or losses from non-core activities. Examples include interest income, interest expense, gains or losses from investments, and one-time items such as legal settlements or restructuring costs.

Income Tax

Income tax represents the amount of tax a company owes on its taxable income. It is calculated based on the applicable tax rate and deductions or credits available.

Net Income or Loss

Net income or loss is the final figure on the income statement, representing the company’s overall profitability for the fiscal year. It is calculated by subtracting income tax and non-operating expenses from operating income.

Creating a Fiscal Year Income Statement Template

Now that we have a clear understanding of the components, let’s discuss the steps involved in creating a comprehensive fiscal year income statement template:

- Gather Financial Data: Collect all relevant financial data for the fiscal year, including revenue, expenses, and tax information. Ensure that the data is accurate and complete.

- Organize the Data: Categorize the data into appropriate sections such as revenue, COGS, operating expenses, non-operating income and expenses, income tax, and net income or loss.

- Calculate Subtotals: Calculate subtotals for each section, such as gross profit (revenue minus COGS) and operating income (gross profit minus operating expenses).

- Include Non-Operating Items: Add non-operating income and expenses to the income statement, ensuring they are clearly labeled and categorized separately from core operating items.

- Calculate Net Income or Loss: Subtract income tax and non-operating expenses from operating income to calculate the final net income or loss.

- Review and Verify: Double-check all calculations and ensure that the income statement is error-free and accurately represents the financial performance of the company.

FAQs (Frequently Asked Questions)

1. What is the purpose of a fiscal year income statement template?

The fiscal year income statement template serves as a comprehensive financial reporting tool that highlights a company’s revenues, expenses, and resulting net income or loss for a specific fiscal year.

2. How often should an income statement be prepared?

Income statements are typically prepared on a quarterly and annual basis. However, companies may choose to create them more frequently for internal reporting purposes.

3. Are there any specific accounting standards for preparing income statements?

Yes, companies need to adhere to generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) when preparing their income statements to ensure consistency and transparency.

4. Can the fiscal year income statement template be used for forecasting future performance?

While the income statement reflects historical financial data, it can provide insights into revenue and expense trends that can aid in forecasting future performance.

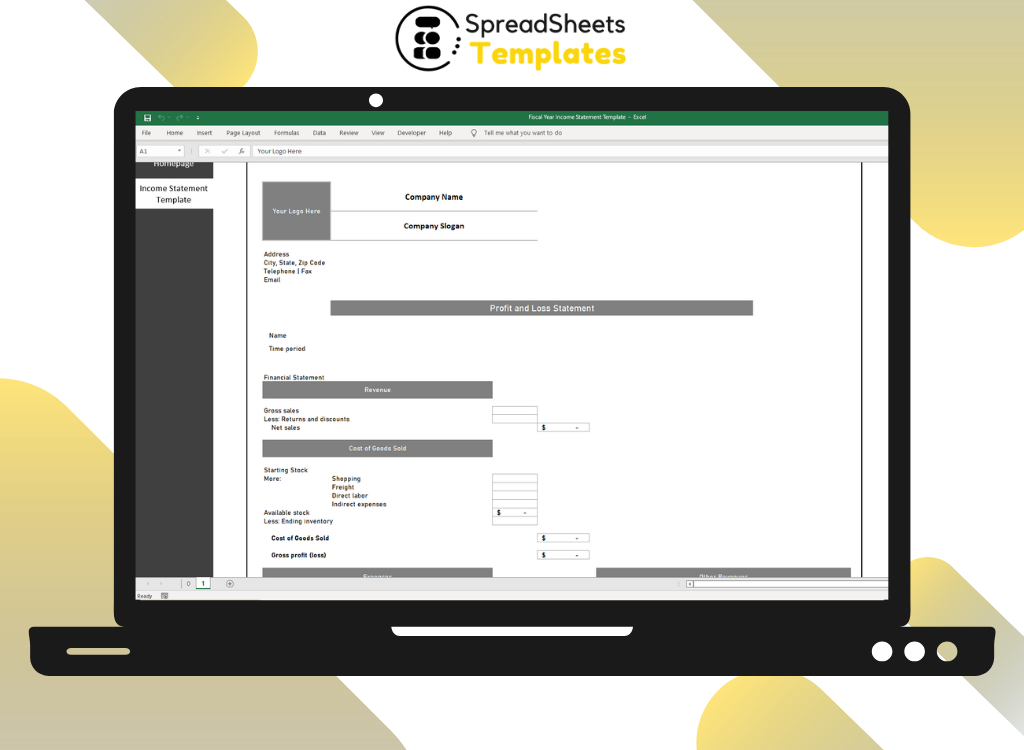

5. Can software or templates help in creating an income statement?

Yes, various accounting software packages and templates are available that can streamline the process of creating an income statement. These tools often come with built-in formulas and pre-defined categories to simplify the task.

6. How can a business improve its net income?

Businesses can improve their net income by increasing revenues through sales growth, managing expenses effectively, optimizing operational efficiency, and implementing cost-saving measures.

Conclusion

The fiscal year income statement template is a vital financial reporting tool that provides a comprehensive overview of a company’s financial performance. By accurately preparing and analyzing income statements, businesses can gain valuable insights, make informed decisions, and ensure compliance with accounting standards. Remember to gather accurate financial data, organize it properly, and review the income statement carefully for accuracy. With a well-prepared income statement, businesses can effectively communicate their financial health and performance to stakeholders, paving the way for continued growth and success.