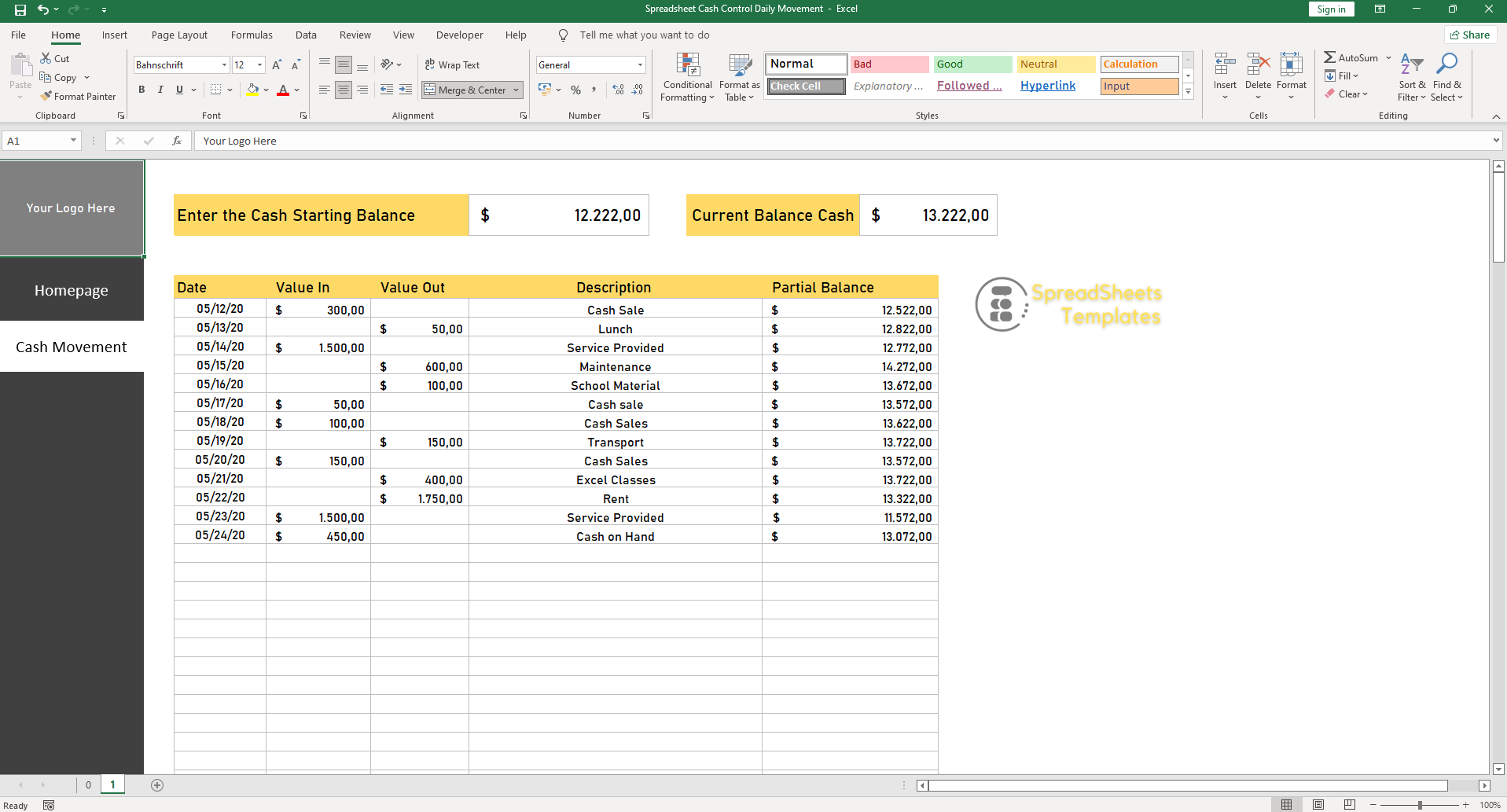

Cash Control Daily Movement

Why use a Cash Control Spreadsheet?

You can avoid running out of money from accounts registered and planned in the Cash Control Daily Movement Excel Spreadsheet.

Through this continuous monitoring, you can determine whether it can afford various expenses such as employee salaries, vendor payments, taxes, etc.

$2.00

CompareWhat is Cash Control?

Cash control deals with all the financial transactions in and out of the company’s cash. This process is absolutely necessary for effective financial control and maintaining the stability of the business.

Therefore, for the company’s balance to be positive, the amount of revenue must exceed the amount of expenses.

Company cash control can be controlled by daily cash control, weekly cash control, cash control or annual cash control.

But it is clear that recording daily or weekly cash control of your income and expenses will bring greater security in the process. It also greatly reduces the chance of error and even reduces the chance of recording cash-relevant information.

By controlling your cash, you can always understand the financial situation of your business. From this, you can accurately determine the source of all expenses and income.

How to control your Cash Control?

You can even manually record all financial transactions in a notebook or journal. However, this process requires you or the team responsible for this control to spend more time.

With a Cash Control Spreadsheet, you not only save time, but also have greater security for your financial records, as you can save spreadsheet files in different locations.

Why use a Cash Control Spreadsheet?

You can avoid running out of money from accounts registered and planned in the Cash Control Daily Movement Excel Spreadsheet.

Through this continuous monitoring, you can determine whether it can afford various expenses such as employee salaries, vendor payments, taxes, etc.

Based on 0 reviews

Only logged in customers who have purchased this product may leave a review.

There are no reviews yet.