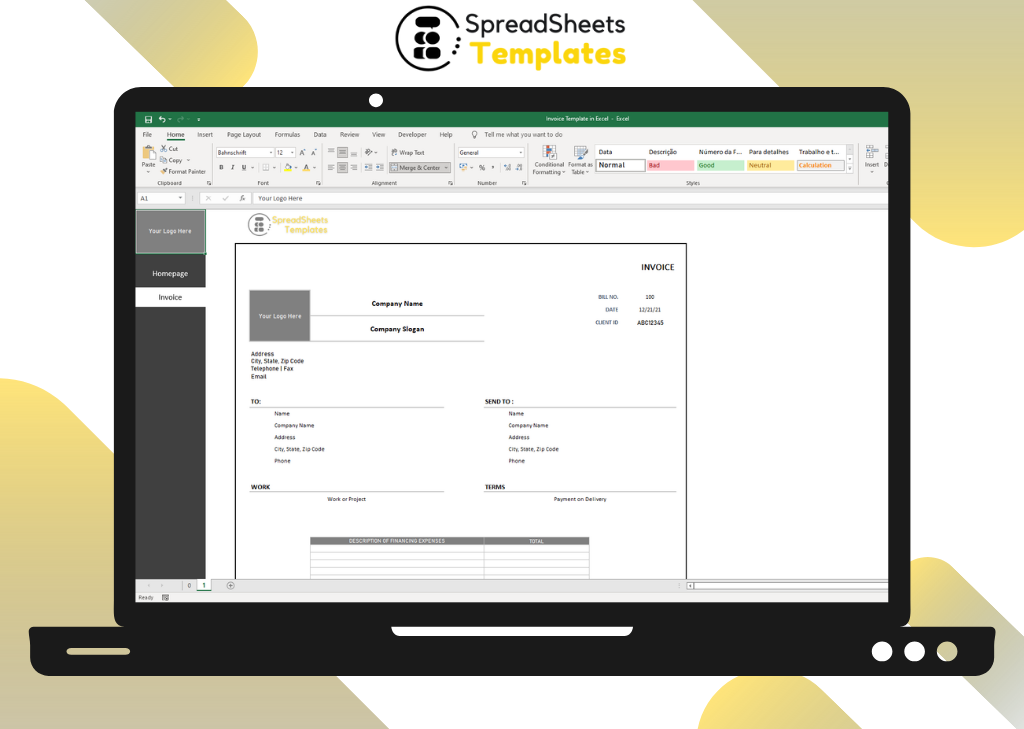

Invoice Template in Excel

If your company is small, but the need for organization is giant. eventually the structure is lean and the resources are more scarce, all the efforts must have the objective to optimize processes and reduce costs.

In this Excel Invoice spreadsheet template you can do financial planning and organize your finances in the best possible way.

This spreadsheet is an example of a ready-made budget, you only need to change the data.

$2.00

CompareThe Excel Invoice Spreadsheet is a very useful tool to control the finances and monthly expenses of any company.

If your company is small, but the need for organization is giant. eventually the structure is lean and the resources are more scarce, all the efforts must have the objective to optimize processes and reduce costs.

In this Excel Invoice spreadsheet template you can do financial planning and organize your finances in the best possible way.

This spreadsheet is an example of a ready-made budget, you only need to change the data.

Service Invoicing is a must-have item for efficient Billing and Collection Management. Therefore, issuing invoices is an excellent way to control what was sold, not only to whom, but for how much, the date, contacts, and much more.

That is why this document is paramount to the operation of a healthy company. Download an Invoice template spreadsheet in Excel for free!

What is the importance of invoices and how does it impact on Collections Management?

First of all, invoicing is important to make clear between the company and the customer what services have been contracted.

Thus, the service invoice is an important management element in two respects:

For the contractor, the invoice is the element that itemizes and records the service to be provided, allowing better control of accounts receivable;

For the contractor, with the invoice issued, it can be inserted in the accounts payable, also facilitating account management.

Above all, for both parties, the invoice issue is an element of “officialization” of the service, facilitating account control and aligning expectations.

How does Service Invoicing relate to Financial Management?

Invoices relate to financial management as an input and output element.

When incoming, the document is issued by the contractor and sent to the customer. The sent document enters the billing flow, signaling the account receivable.

When outgoing, to make any payment you must have an invoice. So each outgoing record (expense) must be associated with an invoice.

This way the expense can be itemized and can be checked when needed.

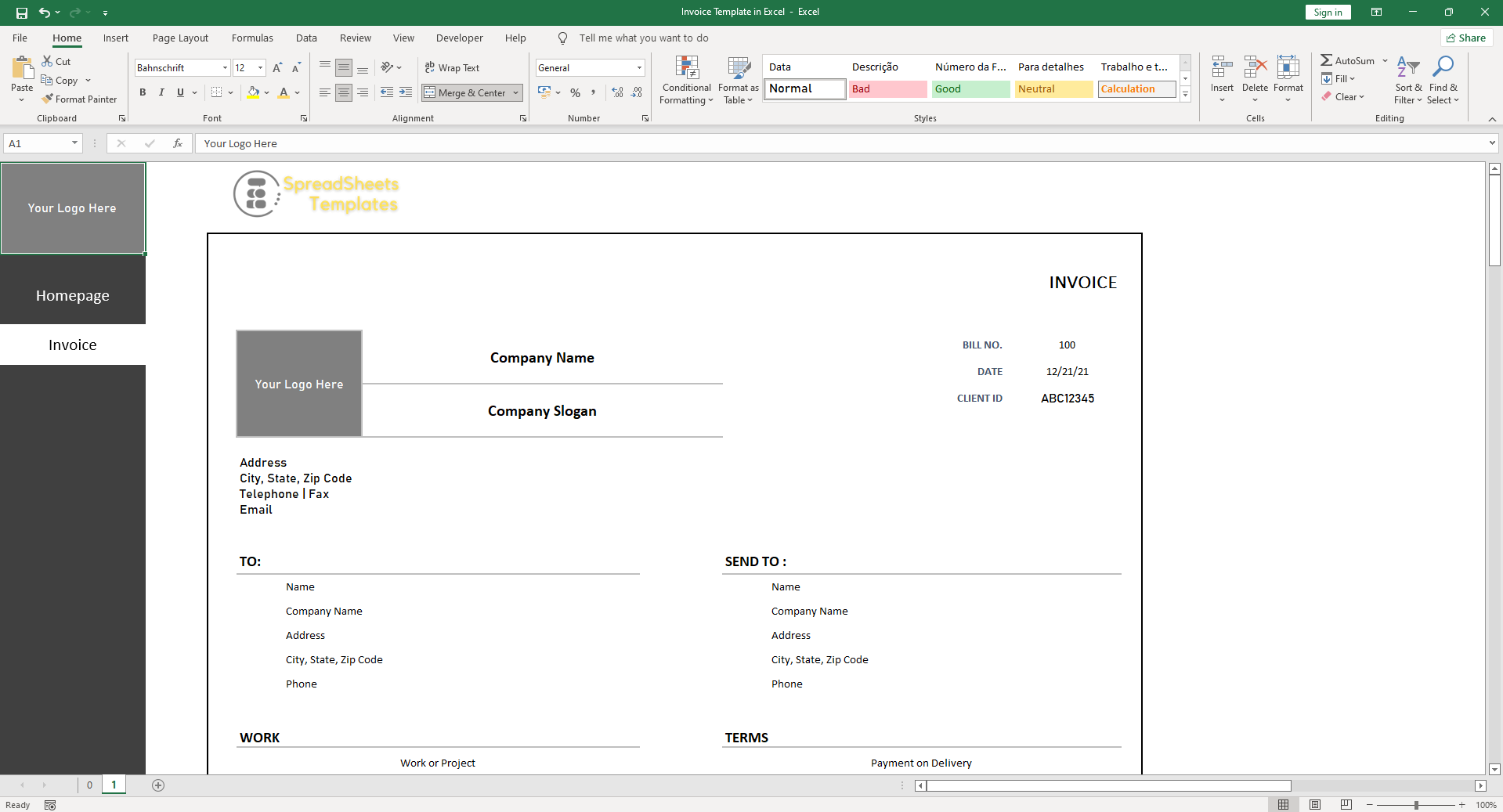

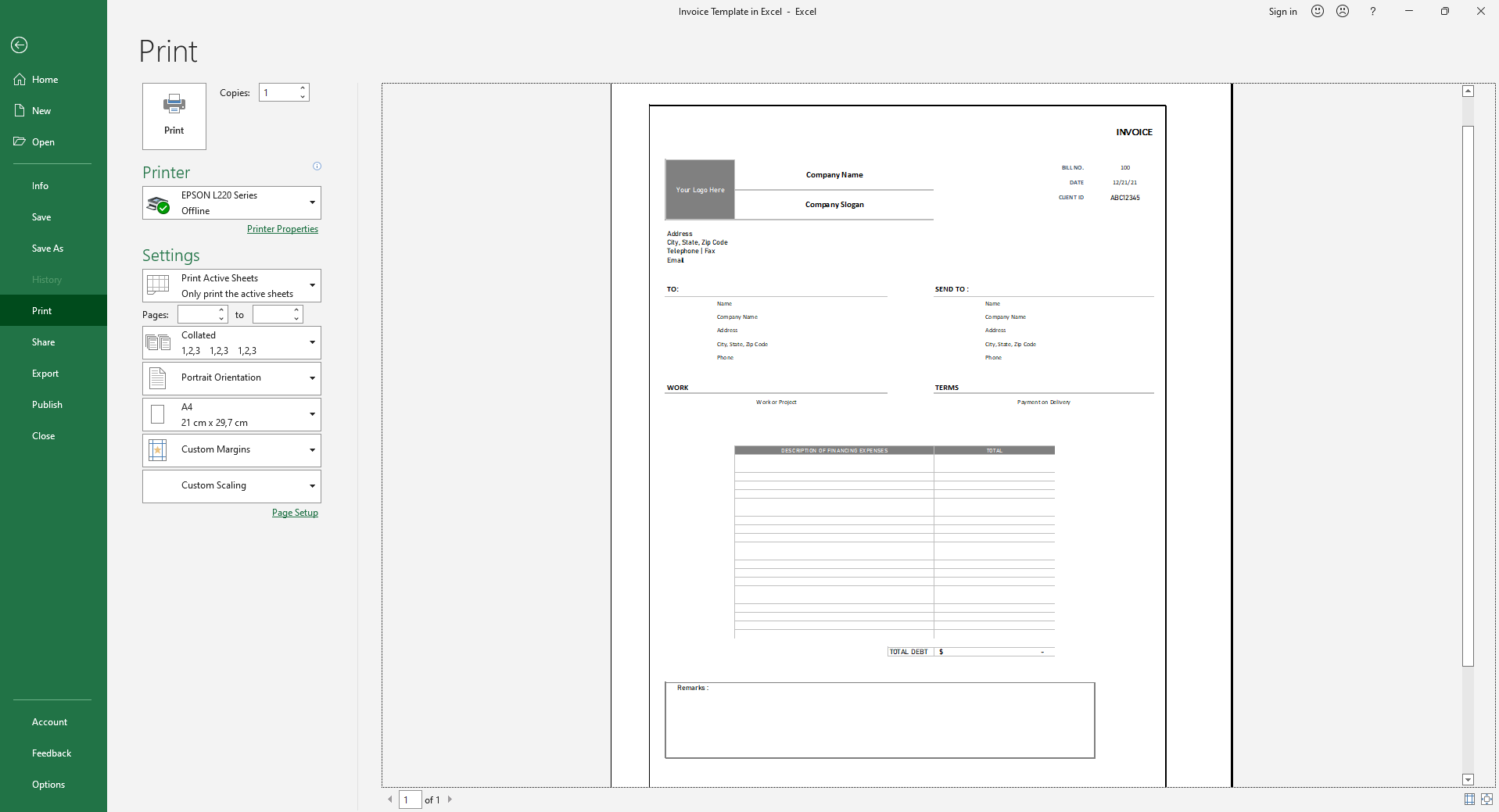

Elements of our Invoices

Date of issue;

Invoice number (sequential numbering);

Name or corporate name of the supplier of goods or service provider;

Nif of the supplier of goods or provider of services;

Name or company name of the recipient of goods or services;

NIF of the recipient of goods or services

Name and quantity of the goods or services;

Value of the provision of services or transfer of goods;

Applicable rates;

Date on which the goods were made available or the services were performed in case the date does not coincide with the invoice’s issue date.

Therefore, the Excel Spreadsheet Coaching for Business Invoice still saves the entrepreneur time, so he will no longer need to spend days calculating something that a simple tool of its kind can calculate automatically. In this way, your company will always be productive.

Based on 0 reviews

Only logged in customers who have purchased this product may leave a review.

There are no reviews yet.