Personal Expense Spreadsheet

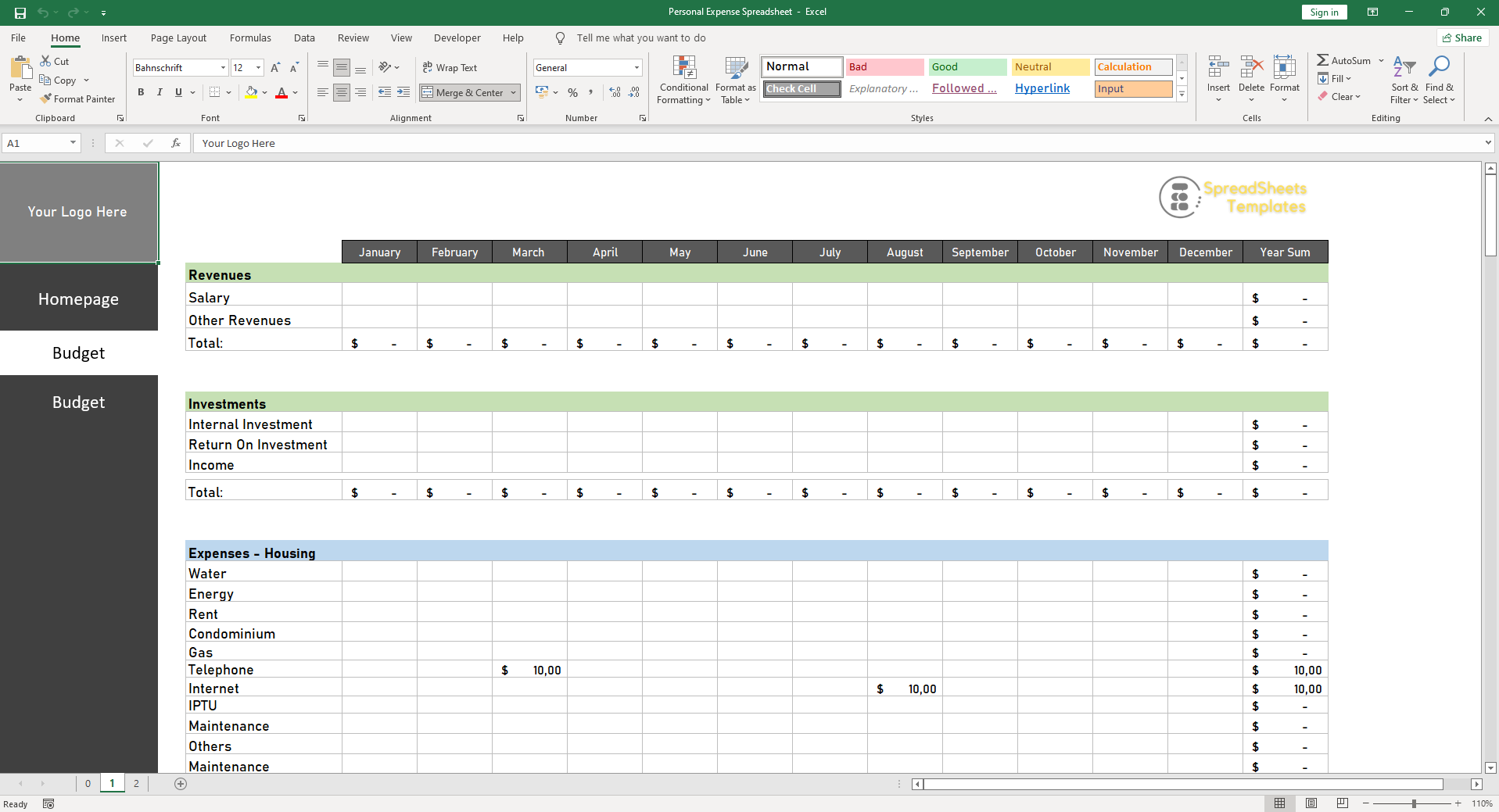

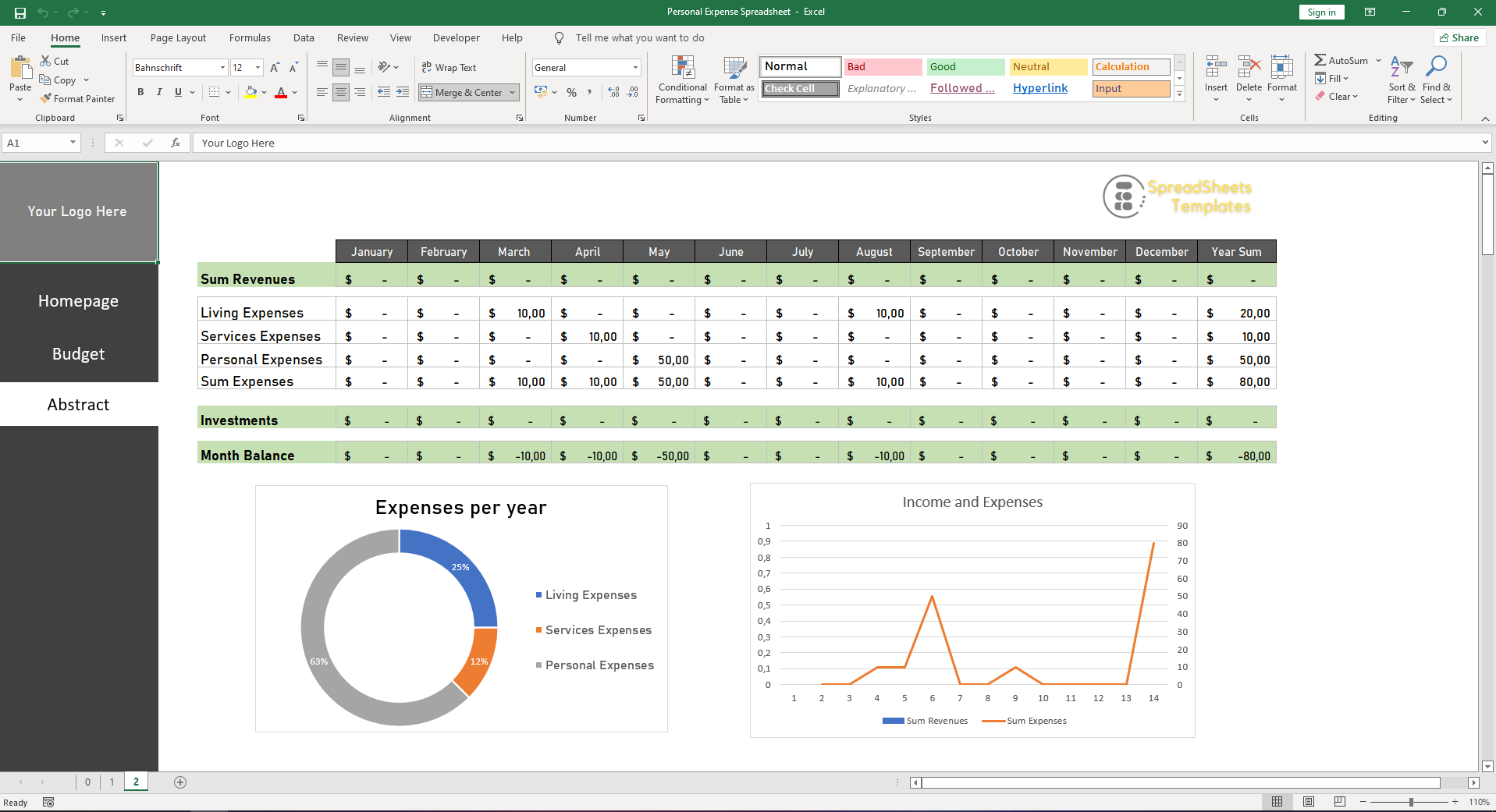

This personal financial control spreadsheet template allows you to view your budget accounts from month to month and throughout the year, and access the consolidated results of the analysis in easy-to-understand graphical form.

$2.00

CompareThe Expense and Budget Excel spreadsheet is a very useful tool for keeping track of your private spending, managing your budget and your monthly expenses.

The Expense and Budget Spreadsheet is a powerful tool, but you must understand that it will be useful in organizing your accounts only if those involved are fully committed.

This personal financial control spreadsheet template allows you to view your budget accounts from month to month and throughout the year, and to access the consolidated results of the analysis in the form of easy-to-understand graphs.

Personal Expense Spreadsheet Family Budget

Personal Expense Spreadsheet Family Budget

For all individual and collective needs to be understandable by everyone, an agreement and collaboration of all will be necessary to meet the same purpose.

Therefore it is necessary to have an understanding of all parties within an environment so that everyone can have a common direction in the personal financial control spreadsheet, and have a transparent reality to be built and implemented with the Spending Sheet.

Thus becoming an environment conducive to the development of a sustainable budget that can serve everyone.

Thinking about these issues, I am bringing four steps for you to plan your household budget the right way

STEP 1: Recognizing the Need for Personal Financial Control

The first step is a diagnosis, an analysis of the current arrangement.

It is necessary to conclude what each individual in the family needs, how much he/she needs to settle his/her monthly bills (both the most basic ones and those that involve ideation and a bigger goal and date) and finally, how much he/she has to contribute to the household budget per month.

STEP 2: WRITE IT DOWN

It is essential to consider and list absolutely all household expenses, including recurring bills and debts that may be overdue or still in payment.

Don’t leave anything out. It is precisely here that the expense spreadsheet will begin to be useful in outlining your household’s accounts.

STEP 3: GOALS

This is a critical step for personal finance, where you need to understand what the common levels of the family are. Are the goals just to split the bills? If not, besides paying the monthly expenses, what do the personalities in this household dream of accomplishing with the surplus amount .

It is important that these ends are realistic and in line with the family’s ability to conduct or afford expenses on a monthly basis.

To develop this stage successfully it is necessary to know in fact how much is really left at the end of the month, and this notice must come fragmenting from the calculation of the benefit and expenses.

4TH STEP: HABIT

To reap the fruits of the roadmap you have made with your family you need to commit yourself, taking responsibility for the choices you have made in the previous stages and also for their consequences.

It is necessary to practice, to know how to live according to what was planned and to transform personal financial control into habits that you will carry throughout your life.

Translated with www.DeepL.com/Translator (free version)

Based on 0 reviews

Only logged in customers who have purchased this product may leave a review.

There are no reviews yet.