Spreadsheet Overtime Calculation

The Overtime Calculation Worksheet is a very useful tool for controlling the finances and monthly expenses of employees in any company.

$2.00

CompareMastering Spreadsheet Overtime Calculation: A Comprehensive Guide for Employers and Employees

Introduction: The Power of Spreadsheet Overtime Calculation

Overtime calculation can be tricky, but it’s a breeze when you harness the power of spreadsheets. Whether you’re an employer aiming for compliance with labor laws or an employee wanting to ensure you’re paid correctly, understanding spreadsheet overtime calculation is vital. Let’s delve into this topic and bring some clarity to this often-misunderstood area.

H2: Spreadsheet Overtime Calculation: Unraveling the Mysteries

What is Spreadsheet Overtime Calculation?

Spreadsheet overtime calculation involves using a spreadsheet to accurately compute overtime pay for employees. With formulas and conditional formatting, spreadsheets can automate calculations, reducing errors and saving time.

Why is Spreadsheet Overtime Calculation Important?

The benefits of spreadsheet overtime calculation are numerous:

- Accuracy: Spreadsheets minimize errors in overtime calculation, ensuring employees are paid correctly and employers meet compliance standards.

- Efficiency: Once set up, spreadsheets automate the calculation process, saving valuable time.

- Transparency: Spreadsheets provide a clear record of hours worked and overtime pay, promoting transparency and trust.

Creating Your Own Overtime Calculation Spreadsheet

Step 1: Set Up Your Spreadsheet

Start by setting up your spreadsheet with the following columns: Employee Name, Date, Regular Hours, Overtime Hours, Regular Pay, Overtime Pay.

Step 2: Input Data

Enter the employee’s regular hours and overtime hours for each day. Regular pay is calculated by multiplying the regular hours by the employee’s hourly wage.

Step 3: Calculate Overtime Pay

Overtime pay is typically 1.5 times the employee’s regular hourly wage. Use a formula to multiply the overtime hours by the overtime rate.

Step 4: Total Pay

Create a final column that adds the regular pay and overtime pay to calculate the total pay for each day.

Maintaining Your Overtime Calculation Spreadsheet

Here are some tips for maintaining your spreadsheet:

- Update Regularly: Ensure accurate records by updating the spreadsheet regularly, preferably daily.

- Review for Accuracy: Regularly review your calculations for accuracy, and correct any errors promptly.

- Backup Your Data: Always keep a backup of your spreadsheet to prevent loss of data.

Spreadsheet Overtime Calculation Templates and Tools

If you’re overwhelmed by the thought of creating an overtime calculation spreadsheet from scratch, consider using a template or tool:

- Microsoft Excel: Numerous free templates are available that can be customized to suit your needs.

- Google Sheets: This cloud-based tool offers shareable templates that can be accessed from anywhere.

- Time Tracking Software: Tools like TSheets or TimeCamp have built-in features for tracking hours and calculating overtime.

FAQs about Spreadsheet Overtime Calculation

1. How often should I update my overtime calculation spreadsheet?

It’s best to update your spreadsheet daily to ensure accurate and up-to-date records.

2. How is overtime calculated?

Typically, overtime is calculated as 1.5 times the regular hourly wage for any hours worked beyond 40 in a workweek.

3. Can a spreadsheet calculate overtime automatically?

Yes, by using formulas, a spreadsheet can automatically calculate overtime pay based on the data you input.

4. Can I use a spreadsheet for different types of overtime rates?

Absolutely! Spreadsheets can be customized to calculate different overtime rates, such as double time for holidays or special events.

5. What if an employee works a split shift?

Split shifts can be recorded and calculated in the spreadsheet by entering each segment of work hours separately and ensuring that the total hours reflect any overtime accrued.

6. How can I ensure my overtime calculation spreadsheet complies with labor laws?

Staying informed about labor laws is crucial. If you’re unsure, consult with a labor law professional to ensure your spreadsheet and calculation methods are compliant.

Conclusion: Mastering the Art of Spreadsheet Overtime Calculation

Understanding spreadsheet overtime calculation is not just about compliance—it’s also a fundamental part of fostering a transparent, fair, and trusting workplace. By accurately calculating and recording overtime pay, both employers and employees can enjoy peace of mind.

Creating and maintaining an overtime calculation spreadsheet might seem like a daunting task, but the benefits far outweigh the effort. Whether you opt to create your own or use a template, your spreadsheet will become an essential tool in your payroll arsenal.

Remember, the key to successful overtime calculation is accuracy, consistency, and a thorough understanding of labor laws. So, roll up your sleeves, dive into those spreadsheets, and master the art of overtime calculation!

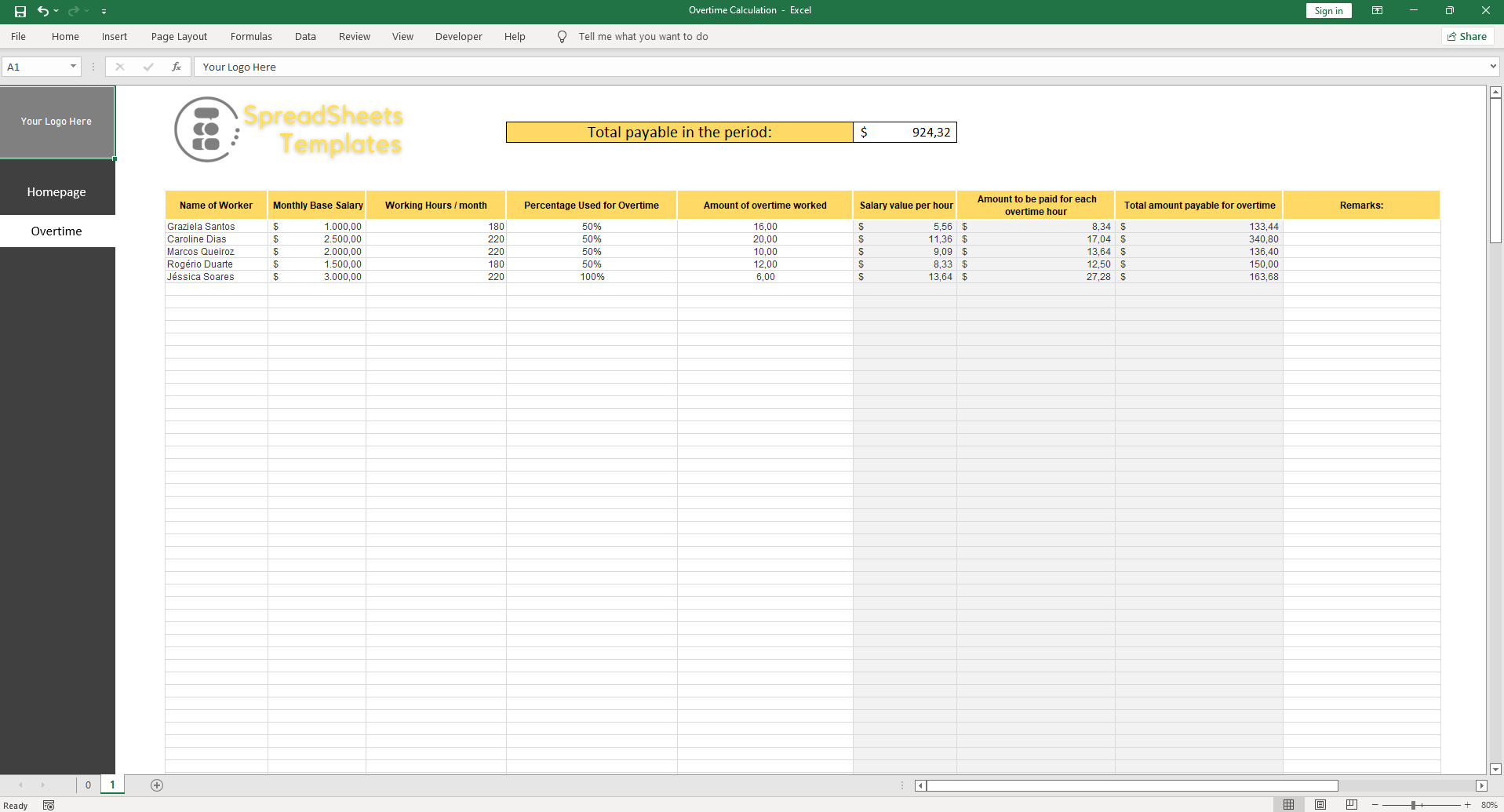

Calculating overtime is a routine task in the human resources area of a company and you can automate the process in a very practical way with this free spreadsheet.

With the spreadsheet developed by the Excel Coaching group you only need to define the basic information to be calculated: the employee’s base salary, the hours of the working day, the bonus percentage, and the amount of overtime worked.

The worksheet uses this information and shows the amount of overtime for each employee and the total amount to be paid.

What is Overtime?

Before you start using the spreadsheet, you need to know what overtime is. Firstly, overtime is a service provided by those who work after the daily working day, which is 8 hours a day and 44 hours a week.

As the name suggests, because it is overtime, the worker is entitled to an additional amount of fifty percent of the normal wage per hour.

The calculation of overtime is the fear of the HR sector when it comes to closing a payroll, or rather, it is the terror of any kind of company.

Curiosity: Did you know that Brazilian workers are the ones who do overtime the most in the world?

That’s right, research indicates that 76% of Brazilians use nine hours or more between once a week and every day.

The Consolidation of Labor Laws also establishes a daily limit of possible overtime of two hours.

In addition, article 59 adds that overtime can only be performed by written agreement between both parties or through a collective bargaining agreement.

The payment of overtime must always be made in cash, and if these hours are worked frequently, they will be part of the employee’s compensation for all legal purposes, such as vacation, FGTS, etc.

What is Time Bank?

To calculate the cost of overtime, many companies work with a time bank as an alternative to compensate the overtime worked through time off.

This model is known for its flexibility, allowing it to be adjusted according to the needs of the company and its employees.

Within this model, there are two forms of negotiation:

Open time bank: overtime is accumulated, but the period of time off is not agreed upon.

Closed time bank: The period of time off is already agreed upon in advance by the company and the employees. But for this, it must be provided for in a collective agreement or convention.

Once an agreement has been reached between the parties, there is a 6-month period in which the time off can be used. In cases where the time off is not used, the company must pay the employee overtime.

Now, if the employee has negative hours, that is, if he/she owes the company for hours worked, the bank may be deducted from his/her salary. These are no longer overtime hours, but hours owed.

The importance of time control for the company

The control of employees’ working hours helps to ensure labor rights, because with this information, it is possible to ensure the fulfillment of obligations such as the payment of overtime and night bonuses.

Moreover, the control of hours is essential to ensure that the hours are fulfilled according to the contract, such as entrance, exit and breaks, and can also control overtime. All the calculation is determined and guaranteed by LAW.

Overtime calculation

Knowing how to correctly calculate overtime worked is important to avoid possible payment errors that can be a margin for labor lawsuits.

To help you calculate correctly, we prepared this spreadsheet that automatically controls the hours worked by your employees.

Based on 0 reviews

Only logged in customers who have purchased this product may leave a review.

There are no reviews yet.