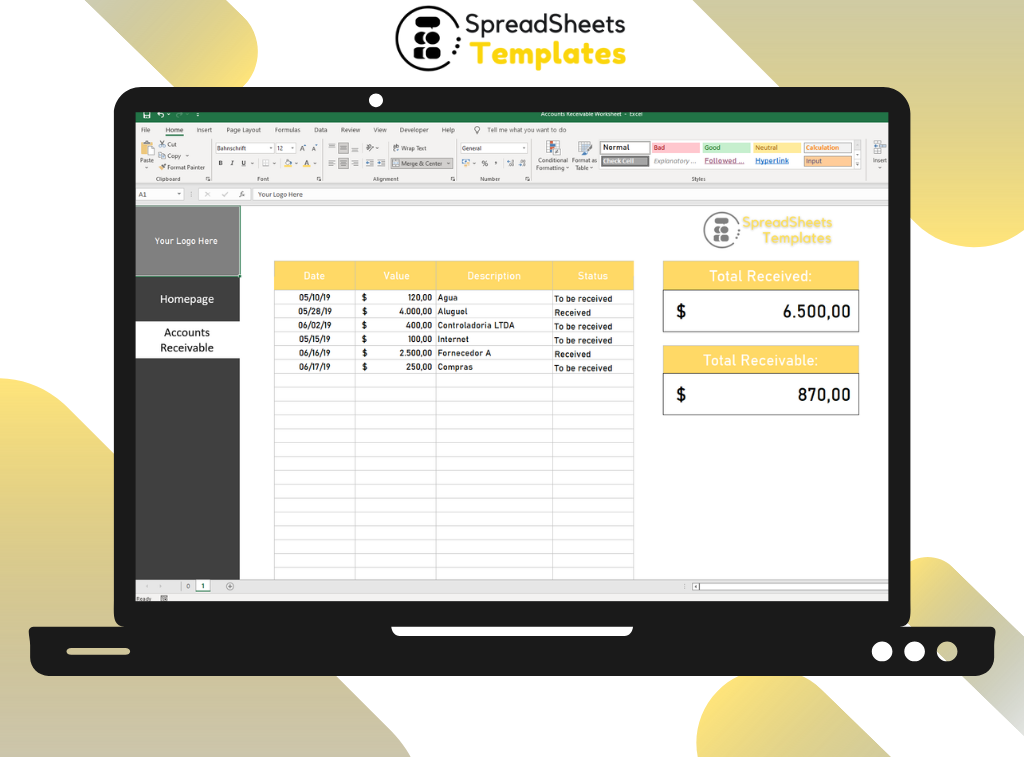

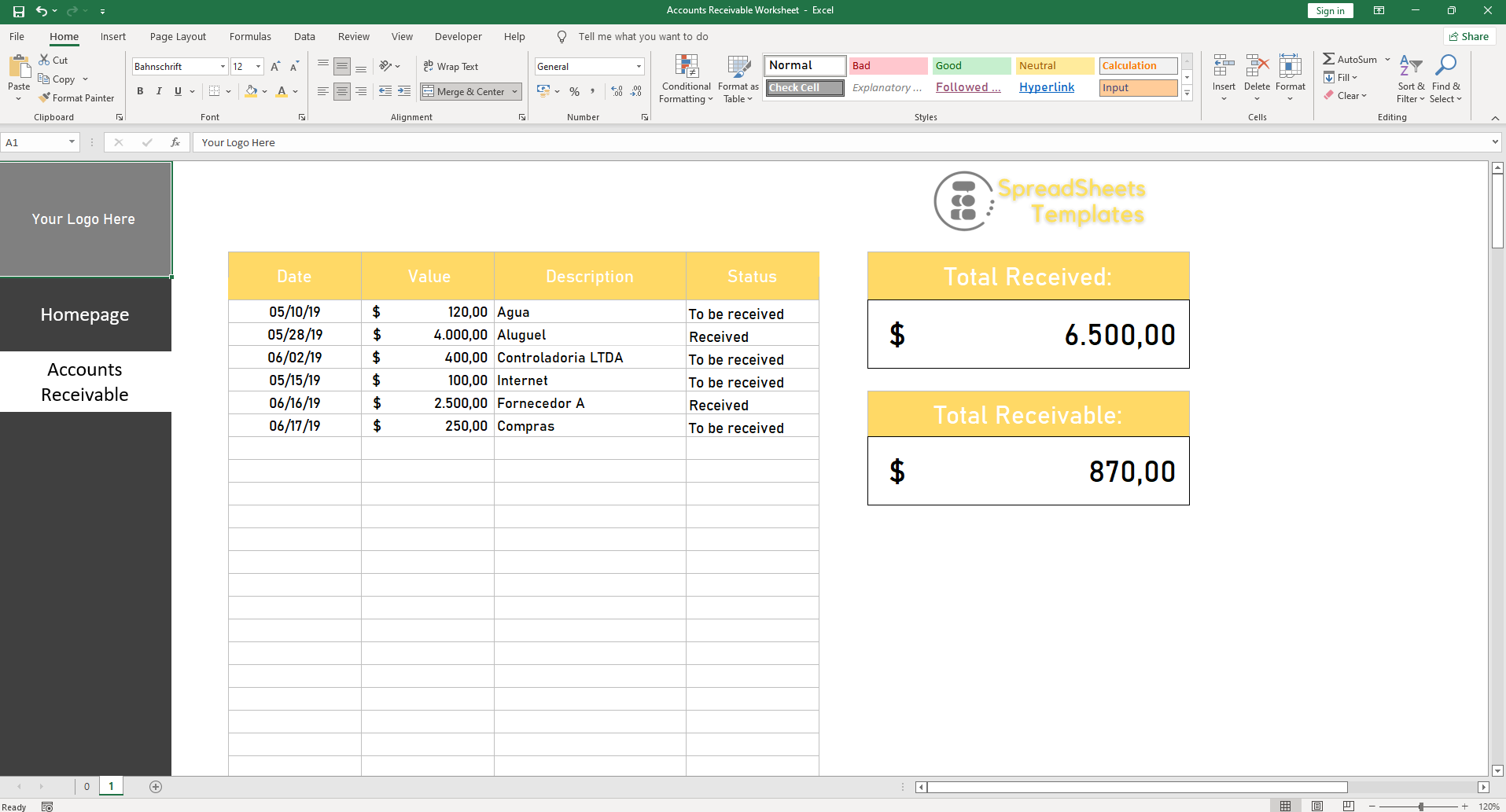

Accounts Receivable Worksheet

The Accounts Receivable spreadsheet is a very useful tool for controlling the monthly finances and expenses of any company.

$2.00

CompareThe Accounts Receivable spreadsheet is a very useful tool for controlling the monthly finances and expenses of any company.

At first, the idea is that this spreadsheet can organize, in a simple way, your receivables management process. In addition, it will be easier to identify the percentage of default of your company, and then, take some measures to reduce it to the maximum.

For an efficient financial management in the company it is necessary to implement some management controls, which provide a system that generates information that enables the effective planning of its activities and control of its results.

Similarly, the control of Accounts Receivable provides information for decision making on one of the most important assets that the company has, the credits receivable arising from sales on term.

Our spreadsheet was developed for you who are tired of using complex tools that are difficult to fill out. It is practical and easy to use, and this manual will help you master it so that you can better control your accounts receivable.

Before any definition of accounts payable and receivable, it is important to emphasize that both must be part of the company’s financial planning, which comes even before the very action of paying or receiving.

Therefore, when this information is put into a spreadsheet or a management system (ERP), these values are a forecast of the money.

But specifically, in accounts receivable is recorded everything that is expected to enter the company’s cash, such as inflows (increases) and outflows (decreases).

You can put bills of credits, promissory notes, or bills of exchange, for example, in this account.

What are the benefits of the Accounts Receivable spreadsheet?

Organization and visibility

It’s no secret that the financial sector is always “putting out fires”. Therefore, it is important to have the main processes in an orderly fashion, to facilitate the execution of tasks.

Likewise, with the accounts receivable spreadsheet, you improve the organization of one of the department’s main tasks.

Thus, it is possible to have a more strategic view of the situation, understand the priorities for an eventual collection, and see which customers are paying on time.

Increased productivity and efficiency in the department

With a more organized department, the average time it takes you and your employees to organize the accounts receivable demands is reduced. Likewise, this allows for more dedication to demands that are part of the company’s core business, innovation, or even process review.

On average, the spreadsheet increases the efficiency of the sector by up to 10%. If you have a small team, this tool is ideal for your department.

Reduction in defaults

This is perhaps the most relevant benefit of this spreadsheet.

With all the information documented in an easy-to-understand way, it is possible to collect from debtors more efficiently.

If we consider the traditional internal collection model, you can have up to a 7% increase in efficiency. And let’s face it, when it comes to revenue, any percentage counts for a lot, doesn’t it?

In addition, your employees will be able to prioritize the collection of more significant debts, or those that are easier to collect; which can positively impact your revenue.

Based on 0 reviews

Only logged in customers who have purchased this product may leave a review.

There are no reviews yet.