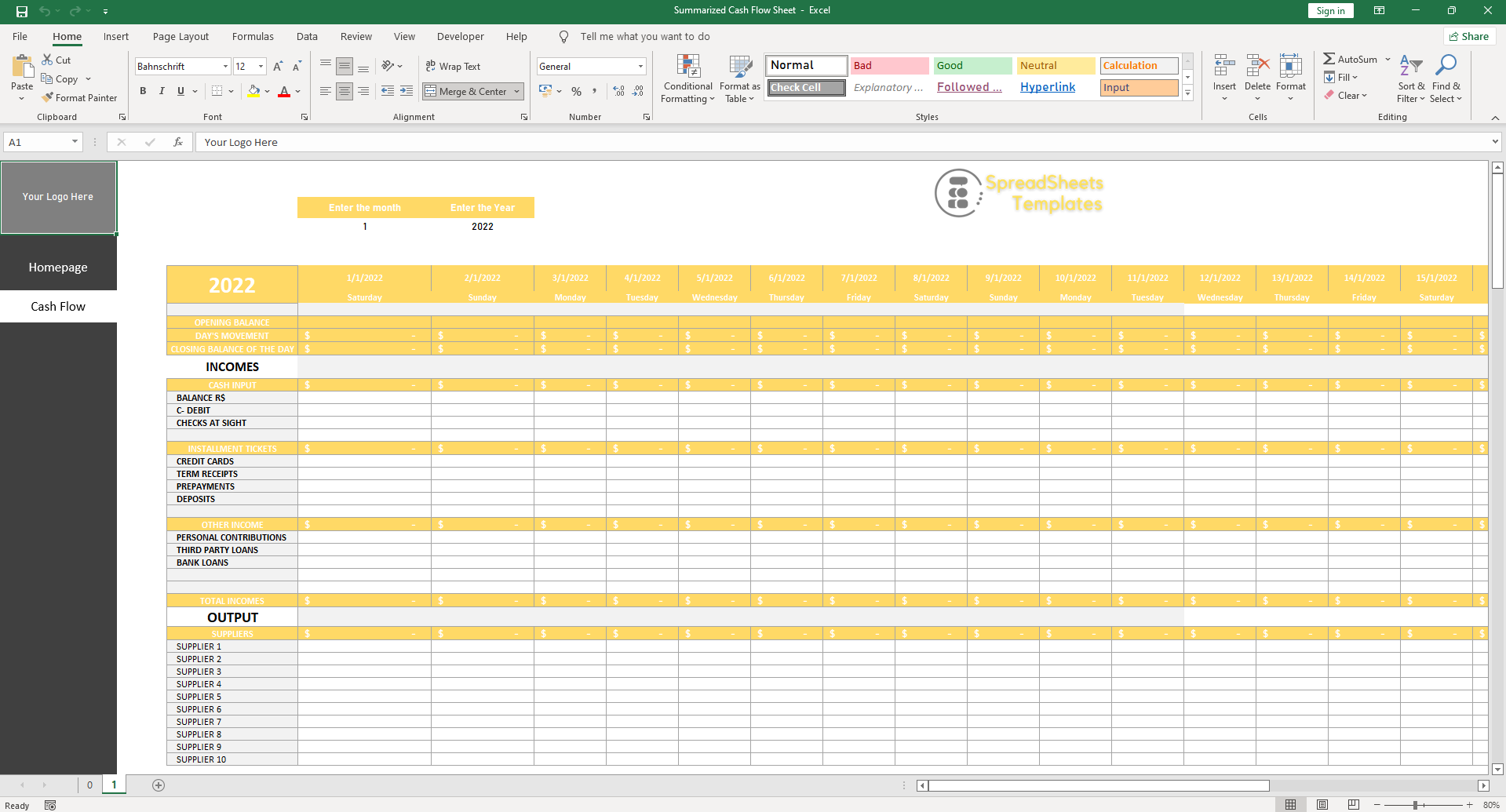

Summarized Cash Flow Sheet

A Summarized Cash Flow Sheet is a condensed representation of the cash flow statement of a company. It provides a quick and concise snapshot of the cash inflows and outflows during a specific period, such as a month, quarter, or year. This financial document categorizes cash flows into three main sections: operating activities, investing activities, and financing activities. By analyzing these categories, businesses can gain valuable insights into their financial health and make informed decisions to optimize their cash flow.

$2.00

CompareUnderstanding and Utilizing Financial Data

Introduction

In the world of finance, understanding and managing cash flow is crucial for the success of any business. A cash flow sheet is a powerful tool that provides a comprehensive overview of the inflows and outflows of cash within an organization. In this article, we will delve deep into the concept of a Summarized Cash Flow Sheet, exploring its significance, components, and how it can be utilized to make informed financial decisions. So let’s dive in and unlock the secrets of effective cash flow management!

Importance of Summarized Cash Flow Sheet

A Summarized Cash Flow Sheet serves as a vital tool for businesses, enabling them to monitor, evaluate, and manage their cash flow effectively. Here are a few key reasons why it is crucial:

- Identifying Cash Flow Patterns: By studying the cash inflows and outflows, businesses can identify patterns and trends, enabling them to forecast future cash flows accurately. This knowledge helps in planning for growth, expansion, or cost-cutting measures.

- Evaluating Financial Performance: A Summarized Cash Flow Sheet provides insights into a company’s financial performance. It helps stakeholders, such as investors and creditors, assess the liquidity and solvency of the business, making it easier to make investment and lending decisions.

- Assessing Cash Availability: By analyzing the cash flow sheet, businesses can determine the availability of cash to meet their short-term obligations. This information is vital for managing day-to-day operations, paying suppliers, and meeting other immediate financial commitments.

Components of a Summarized Cash Flow Sheet

A well-structured Summarized Cash Flow Sheet comprises several key components that provide a comprehensive overview of a company’s cash flow. Let’s explore each of these components in detail:

1. Operating Activities

Operating activities represent the core revenue-generating activities of a business. They include cash inflows from sales, service revenue, and accounts receivable, as well as cash outflows for operating expenses, inventory purchases, and payments to suppliers. This section of the Summarized Cash Flow Sheet helps assess the cash flow generated from day-to-day operations.

2. Investing Activities

Investing activities involve cash flows related to the acquisition or sale of long-term assets, such as property, equipment, or investments. Cash inflows in this category include proceeds from the sale of assets or investments, while cash outflows comprise the purchase of new assets or investments. Analyzing this section helps evaluate the impact of investment decisions on cash flow.

3. Financing Activities

Financing activities encompass cash flows related to the company’s capital structure and financing decisions. Cash inflows in this section include proceeds from issuing stock, borrowing, or receiving loans. Cash outflows involve repaying debt, paying dividends, or buying back stock. Understanding the financing activities helps assess the company’s capital structure and its ability to raise funds.

4. Net Cash Flow

The net cash flow represents the difference between total cash inflows and outflows. It indicates the overall cash position of the business during the specified period. A positive net cash flow indicates a surplus, while a negative net cash flow signifies a deficit.

5. Opening and Closing Cash Balance

The opening cash balance is the cash available at the beginning of the period, while the closing cash balance is the cash available at the end of the period. These balances provide insights into the liquidity of the business and its ability to meet financial obligations.

How to Utilize a Summarized Cash Flow Sheet

Now that we have gained a solid understanding of the components of a Summarized Cash Flow Sheet, let’s explore how businesses can effectively utilize this financial tool to make informed decisions:

- Forecasting Cash Flow: By analyzing past cash flow data and trends, businesses can forecast future cash flows. This enables them to plan for contingencies, manage working capital effectively, and make informed investment decisions.

- Identifying Cash Flow Issues: A Summarized Cash Flow Sheet helps businesses identify potential cash flow issues well in advance. By recognizing cash flow gaps, they can take proactive measures such as renegotiating payment terms with suppliers, reducing expenses, or seeking additional financing.

- Optimizing Working Capital: Efficient working capital management is crucial for the smooth operation of a business. By carefully monitoring the cash flow sheet, businesses can optimize their working capital by streamlining accounts payable, improving collections, and managing inventory effectively.

- Assessing Investment Opportunities: The Summarized Cash Flow Sheet assists in evaluating investment opportunities. By understanding the cash flow implications of a potential investment, businesses can make informed decisions about capital expenditure and the allocation of financial resources.

FAQ (Frequently Asked Questions)

Q1: What is the ideal frequency for preparing a Summarized Cash Flow Sheet?

A1: The frequency of preparing a Summarized Cash Flow Sheet depends on the specific needs of the business. Most businesses prepare it on a monthly, quarterly, or annual basis. However, businesses with more complex cash flow dynamics might require more frequent reporting, such as weekly or bi-weekly.

Q2: Can a Summarized Cash Flow Sheet help in detecting financial irregularities or fraud?

A2: Yes, a Summarized Cash Flow Sheet can be instrumental in detecting financial irregularities or fraud. By carefully analyzing the cash flow patterns and unexpected fluctuations, businesses can identify potential red flags and investigate further to uncover any fraudulent activities.

Q3: How can a Summarized Cash Flow Sheet help in securing financing from banks or investors?

A3: A Summarized Cash Flow Sheet provides banks or investors with a clear picture of a company’s financial health. By demonstrating a positive and consistent cash flow, businesses increase their credibility and enhance their chances of securing financing at favorable terms.

Q4: Is it necessary for small businesses to prepare a Summarized Cash Flow Sheet?

A4: Yes, preparing a Summarized Cash Flow Sheet is crucial for small businesses as well. It helps them gain better control over their cash flow, identify potential challenges, and make informed financial decisions. Effective cash flow management is vital for the long-term sustainability and growth of any business, regardless of its size.

Q5: Can a Summarized Cash Flow Sheet be used for personal finance management?

A5: While a Summarized Cash Flow Sheet is primarily designed for businesses, individuals can also utilize a simplified version for personal finance management. By categorizing personal cash inflows and outflows, individuals can gain a better understanding of their spending habits, savings potential, and financial goals.

Q6: Are there any software tools available to automate the creation of a Summarized Cash Flow Sheet?

A6: Yes, several accounting software and financial management tools offer features to automate the creation of a Summarized Cash Flow Sheet. These tools streamline the process, reduce errors, and provide real-time visibility into cash flow. Popular options include QuickBooks, Xero, and FreshBooks.

Conclusion

A Summarized Cash Flow Sheet is a powerful financial tool that provides businesses with valuable insights into their cash flow dynamics. By carefully analyzing the components of a Summarized Cash Flow Sheet, businesses can make informed decisions, optimize working capital, and ensure financial stability. Understanding the inflows and outflows of cash is essential for long-term success, and the Summarized Cash Flow Sheet plays a pivotal role in achieving this goal.

So, leverage the power of the Summarized Cash Flow Sheet to take control of your business’s financial health and pave the way for sustainable growth and profitability.

Based on 0 reviews

Only logged in customers who have purchased this product may leave a review.

There are no reviews yet.