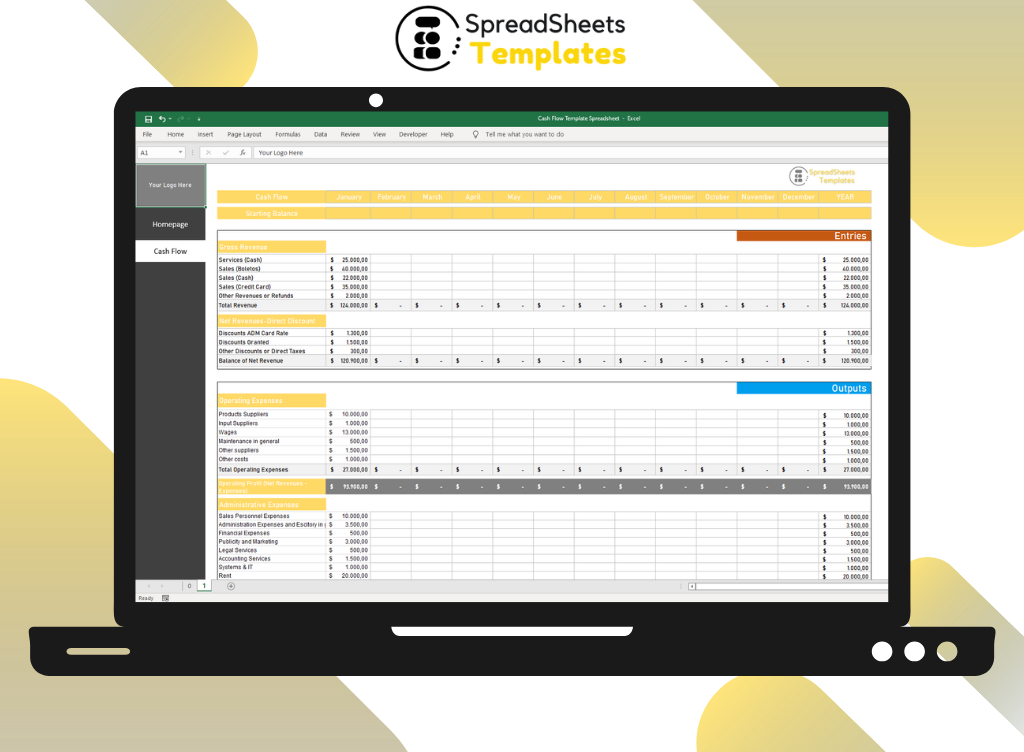

Cash Flow Template Spreadsheet

The Cash Flow Template is a very useful tool for controlling the finances and monthly expenses of any company.

Even though the importance of financial control is paramount, many companies still face problems due to lack of proper planning and follow-up. With this in mind, Excel Coaching has created a practical Excel cash flow tool, ready for you to use in your daily routine.

$2.00

CompareThe Cash Flow Template in Excel allows you to register all the actions that have been performed in your company’s cash, therefore, containing essential fields to be filled in, and may give a management in decision making improved cash control.

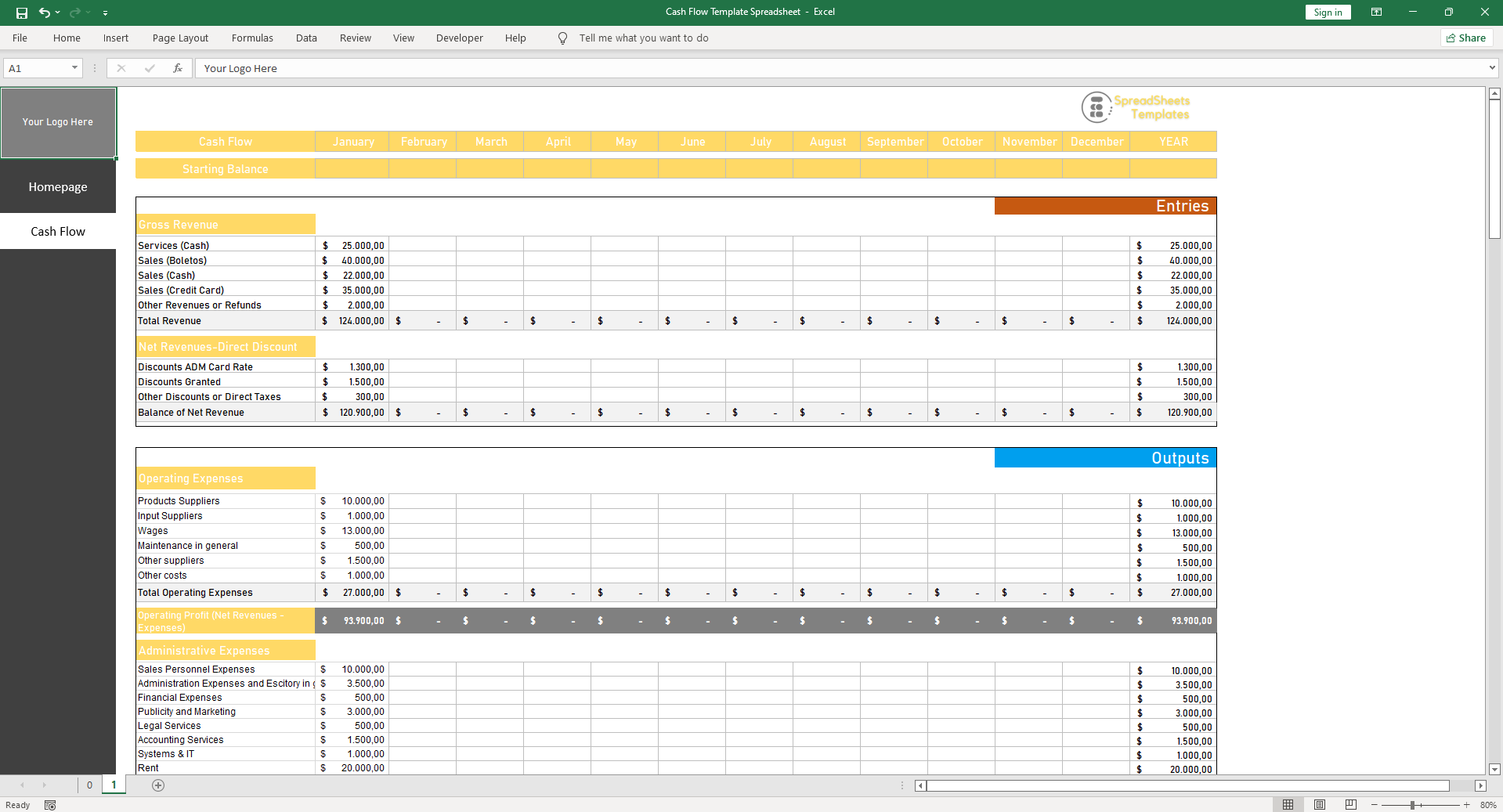

In the cash flow follow-up, all the movements must be registered, which is essential to have a real control of the company’s financial situation.

What is cash flow?

Cash flow is a tool in which the administrator plans and manages the company’s incoming and outgoing capital.

It is not a control of the bank balance, because the cash flow includes the projection of sales and accounts payable and receivable for the following months.

Cash flow is the control of all the financial movements in and out of your company’s cash.

Having a well-structured cash flow, with frequent use, offers some advantages to the entrepreneur, and doing this process is absolutely essential for efficient financial control and for maintaining the stability of your business.

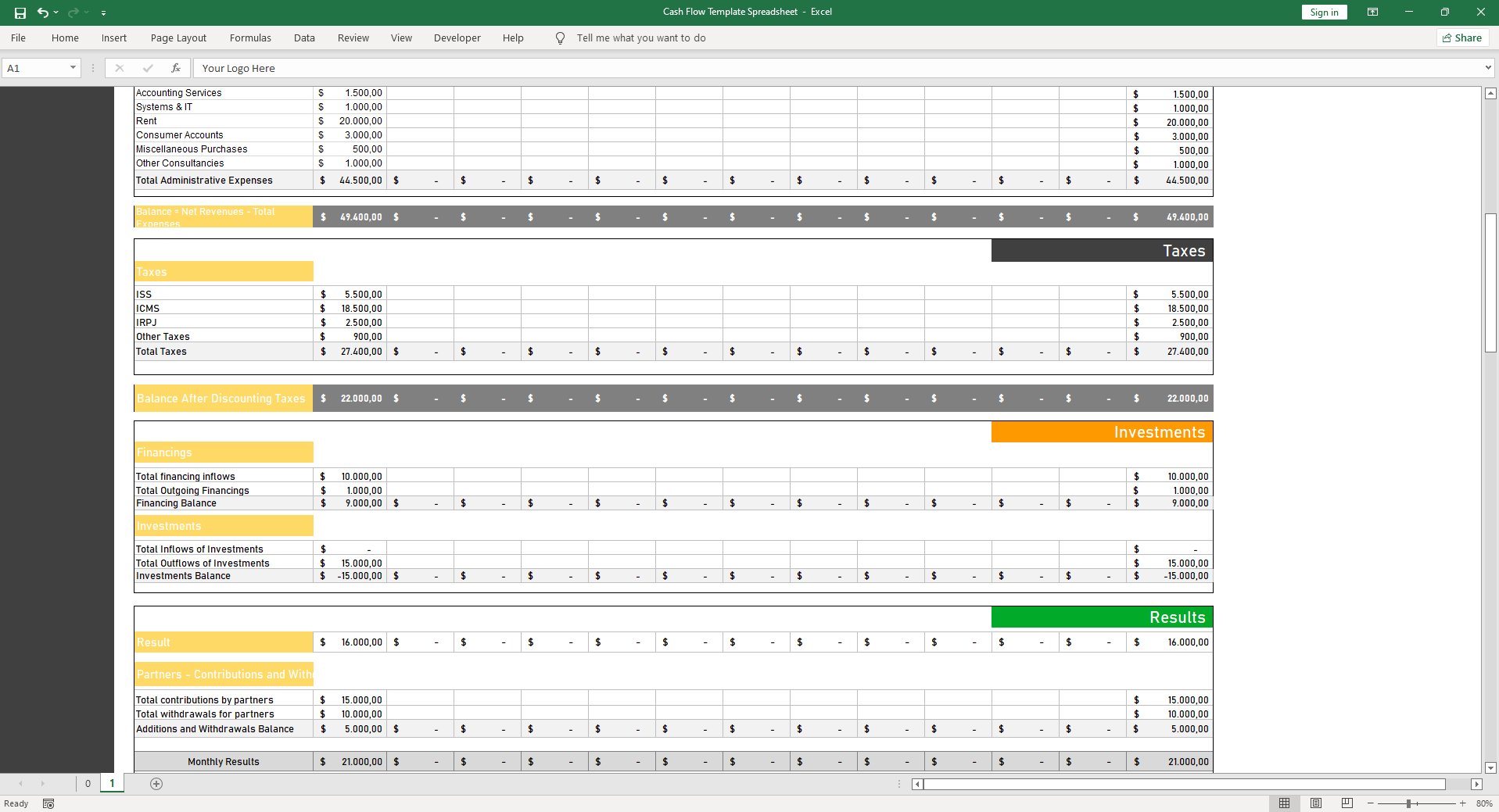

Thus, for the company’s balance to be positive, it is necessary that the amounts of income are greater than the expenses.

Your company’s cash flow can be controlled with a daily cash flow, a weekly cash flow, a monthly cash flow, or an annual cash flow.

But for sure, recording a daily or weekly cash flow of your income and expenses brings much more security in this process. In addition, it considerably reduces the chances of mistakes and even forgetting to record information relevant to your cash flow.

With the control of your cash flow you always keep up to date on the financial situation of your business.

From it, you can identify in a precise way the origin of all your expenses and receipts.

This analysis of your company’s income and expenses helps the entrepreneur in the decision making process.

This is because it indicates possible overspending that can be cut from the budget. Thus, also verifying if your company is in good conditions to make new investments.

How to control your cash flow?

The registration of all your financial movements can even be done manually in a notebook or diary. Therefore, this process demands more time from you or from your team responsible for this control.

With an Excel Cash Flow Spreadsheet, you not only save time, but you also have much more security in recording your finances, since you can save your spreadsheet file in different locations.

An important tip: The only way to enjoy the benefits of the spreadsheet and get an accurate picture of the company’s actual balance is to use it consistently, including all entries in the spreadsheet with the correct dates.

Why use a Cash Flow Spreadsheet?

From the accounts registered and projected in your spreadsheet you avoid running short of cash. With this continuous follow-up you identify if you can afford your most varied expenses, such as employees’ salaries, suppliers’ payments, taxes, among others.

Advantages of the Cash Flow Spreadsheet

Better management of your accounts payable and receivable: with the registration of all your company’s accounts, you will find it much easier to control the payment and receipt deadlines. Thus, avoiding indebtedness.

Cash projection: by registering your accounts on the cash flow spreadsheet you can clearly project the future situation of your budget.

Organization: with the segmentation of all your income and expenses, indicating the origin of each one, you can view in a simplified way which are the factors that cause a greater impact on your budget.

Organize your accounts

Whatever solution you are going to implement, the important thing is to have two objectives in mind:

Financial organization

Productivity.

This spreadsheet is one that respects these two premises.

From the registration of revenues and expenses paid or received in the cash flow spreadsheet is projected. Thus, it is possible to manage your future accounts payable and receivable. It is of great importance for your company, because it allows you to evaluate the need for capital.

Based on 0 reviews

Only logged in customers who have purchased this product may leave a review.

There are no reviews yet.