Personal Expense Spreadsheet Leave a comment

Managing Your Finances Made Easy

Introduction

In today’s fast-paced world, managing personal finances can be a daunting task. With numerous expenses to track and budgets to maintain, it’s easy to feel overwhelmed. However, thanks to technological advancements, there is a solution that can simplify your financial management process: the personal expense spreadsheet. In this comprehensive guide, we will explore the benefits of using a personal expense spreadsheet, how to create one, and tips for effectively managing your finances. So, let’s dive in and take control of your financial future!

Personal Expense Spreadsheet: A Game Changer

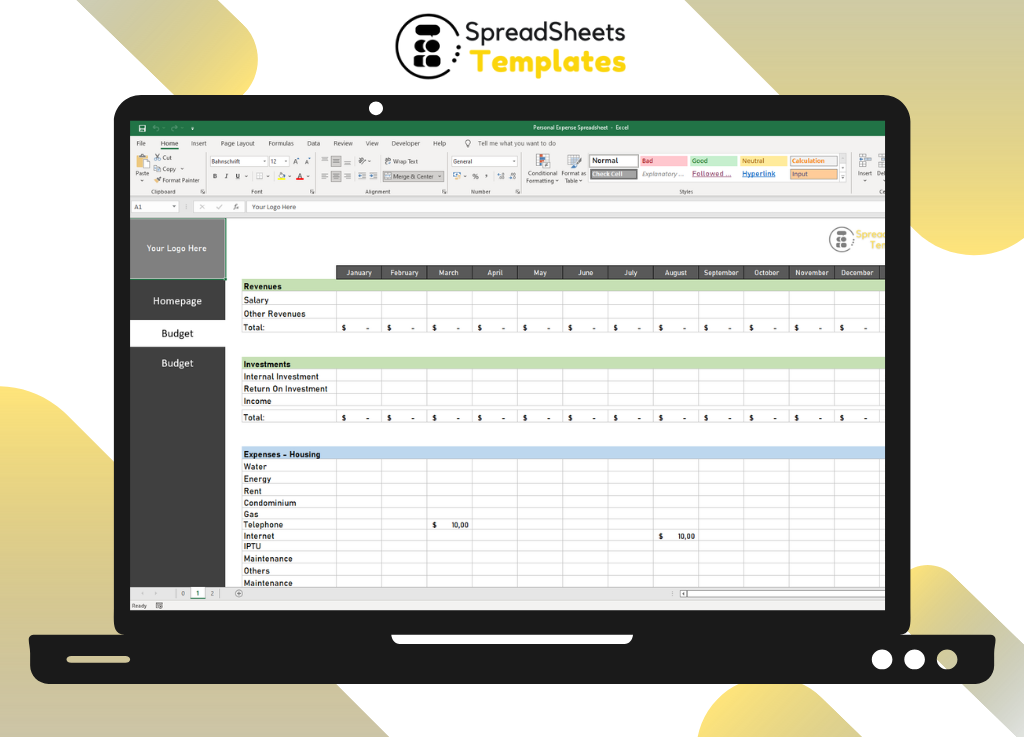

A personal expense spreadsheet is a powerful tool that allows you to track and manage your income, expenses, and savings effectively. By organizing your financial information in a structured format, you gain valuable insights into your spending habits and can make informed decisions to optimize your finances. Here are some key reasons why a personal expense spreadsheet is a game changer:

1. Clear Overview of Your Finances

With a personal expense spreadsheet, you can have a clear overview of your financial situation at a glance. By categorizing your income and expenses, you can easily identify where your money is going and identify areas where you can make adjustments to save more.

2. Budget Planning and Tracking

Creating a budget is essential for achieving your financial goals. A personal expense spreadsheet allows you to set budget limits for different expense categories and track your actual spending against these limits. This way, you can ensure that you stay on track and avoid overspending.

3. Identifying Saving Opportunities

A personal expense spreadsheet helps you identify potential saving opportunities. By analyzing your expenses, you can pinpoint areas where you are spending more than necessary and find ways to cut back. This newfound awareness can lead to significant savings over time.

4. Financial Goal Tracking

Whether you’re saving for a down payment on a house, planning a dream vacation, or building an emergency fund, a personal expense spreadsheet can help you track your progress towards your financial goals. By regularly updating your spreadsheet with your savings and investment contributions, you can visualize your journey and stay motivated.

How to Create Your Personal Expense Spreadsheet

Now that you understand the benefits of using a personal expense spreadsheet, it’s time to create your own. Follow these step-by-step instructions to get started:

Step 1: Choose a Spreadsheet Software

There are several spreadsheet software options available, such as Microsoft Excel, Google Sheets, or Apple Numbers. Select the software that suits your preferences and familiarity.

Step 2: Set Up the Basic Structure

Create a new spreadsheet and set up the basic structure. Start by labeling the columns with headers such as “Date,” “Description,” “Category,” “Income,” and “Expense.”

Step 3: Categorize Your Income and Expenses

Create categories for your income and expenses. Common categories may include “Salary,” “Rent/Mortgage,” “Utilities,” “Groceries,” “Transportation,” and “Entertainment.” Customize the categories to align with your specific financial situation.

Step 4: Enter Your Transactions

Enter your income and expenses in the respective rows of your spreadsheet. Make sure to include the date, description, category, and amount for each transaction. This step requires discipline and regular updating to maintain an accurate representation of your finances.

Step 5: Apply Formulas for Calculations

Leverage the power of spreadsheet formulas to automate calculations. Use sum formulas to calculate the total income and expenses for each category and overall. This will provide you with a clear picture of your financial inflow and outflow.

Step 6: Create Visual Representations

To make your spreadsheet more visually appealing and easier to comprehend, consider creating charts and graphs. Visual representations can help you identify spending patterns and trends quickly.

Step 7: Regularly Update and Review

Make it a habit to regularly update and review your personal expense spreadsheet. Set aside dedicated time each week or month to input new transactions and analyze your financial progress. This practice will ensure that your spreadsheet remains an accurate reflection of your finances.

FAQs About Personal Expense Spreadsheets

1. Why should I use a personal expense spreadsheet instead of mobile apps or online tools?

Personal expense spreadsheets offer greater customization options and flexibility compared to pre-designed mobile apps or online tools. You can tailor the spreadsheet to fit your specific needs, and you have full control over the data. Additionally, spreadsheets can be accessed offline, ensuring you have access to your financial information anytime, anywhere.

2. Can I use a personal expense spreadsheet for business expenses as well?

Yes, personal expense spreadsheets can be adapted for business use. By creating separate sheets or tabs, you can track both personal and business expenses within the same spreadsheet. This approach helps you maintain a comprehensive view of your overall financial health.

3. Are there any ready-made personal expense spreadsheet templates available?

Yes, you can find various pre-designed personal expense spreadsheet templates online. These templates offer a starting point and can save you time in creating your own spreadsheet from scratch. However, it’s essential to customize the template to align with your unique financial situation.

4. How secure is my financial data in a personal expense spreadsheet?

When using spreadsheet software installed on your local device, it’s crucial to ensure you have adequate security measures in place. Password-protecting your spreadsheet and regularly backing up your data are essential steps to safeguard your financial information.

5. Can I share my personal expense spreadsheet with my spouse or partner?

Yes, personal expense spreadsheets can be easily shared with your spouse or partner. Most spreadsheet software allows you to collaborate and grant specific permissions to other users. This way, you can both contribute to the spreadsheet and have a shared understanding of your financial situation.

6. Should I use a personal expense spreadsheet even if I have a financial advisor?

Absolutely! A personal expense spreadsheet complements the guidance provided by a financial advisor. It gives you a hands-on understanding of your finances, enabling more productive conversations with your advisor. By actively managing your expenses, you become an informed participant in your financial planning.

Conclusion

Taking control of your personal finances starts with effective management, and a personal expense spreadsheet empowers you to achieve just that. By organizing your income, expenses, and savings in one place, you gain clarity and control over your financial life. So, start creating your personal expense spreadsheet today and take the first step toward financial freedom!