Accounts Receivable Worksheet Leave a comment

A Comprehensive Guide for Effective Financial Management

Introduction

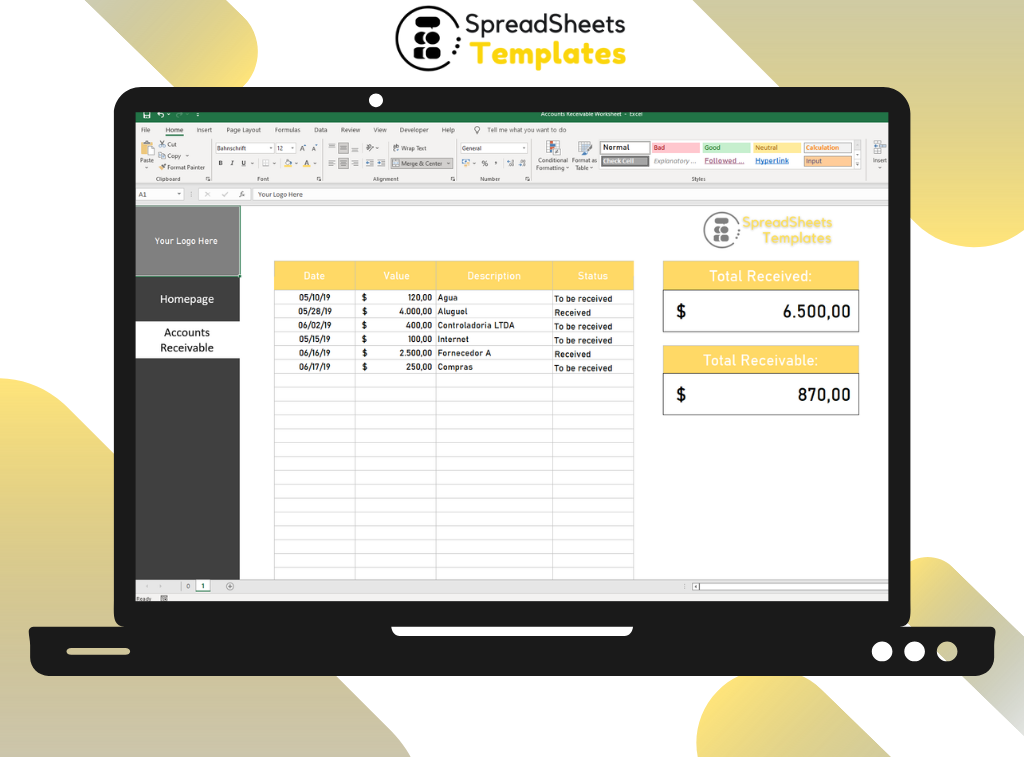

Welcome to our comprehensive guide on accounts receivable worksheets, an essential tool for effective financial management. In this article, we will delve into the importance of accounts receivable worksheets and how they can help businesses keep track of their finances. We will explore various aspects of accounts receivable, including its definition, benefits, and how to create an effective worksheet. So, let’s dive in and gain valuable insights into this crucial financial tool!

Accounts Receivable Worksheet: An Overview

Accounts receivable refers to the outstanding payments owed to a business for goods or services provided to its customers on credit. It represents the money that is yet to be collected by the business. Managing accounts receivable is crucial for maintaining a healthy cash flow and ensuring the financial stability of a company.

The Significance of Accounts Receivable Worksheets

An accounts receivable worksheet is a powerful tool that helps businesses streamline their financial processes. It enables them to track and manage their outstanding invoices and monitor customer payments effectively. By utilizing an accounts receivable worksheet, businesses can:

- Keep a Record of Transactions: A well-structured worksheet allows businesses to maintain a detailed record of their sales transactions, including the amount owed, the due dates, and the payment status.

- Identify Outstanding Balances: The worksheet enables businesses to identify customers with outstanding balances, allowing them to take necessary actions to collect payments promptly.

- Monitor Cash Flow: By regularly updating the accounts receivable worksheet, businesses can have a clear picture of their cash flow, ensuring they have sufficient funds to cover their expenses and investments.

- Enhance Financial Planning: With accurate and up-to-date information provided by the worksheet, businesses can make informed decisions regarding their financial strategies, such as setting credit limits and payment terms.

- Improve Customer Relationships: A well-managed accounts receivable process fosters stronger customer relationships by ensuring timely and accurate invoicing, thereby enhancing customer satisfaction.

Creating an Effective Accounts Receivable Worksheet

Now that we understand the significance of accounts receivable worksheets let’s delve into the process of creating an effective worksheet. Follow these steps to ensure your worksheet serves as a valuable tool for managing your accounts receivable:

Step 1: Set Up a Template

Start by creating a template that suits your business requirements.

:

- Invoice Number: Assign a unique identifier to each invoice for easy tracking and reference.

- Customer Information: Include the customer’s name, contact details, and any other relevant information.

- Invoice Date: Record the date when the invoice was issued.

- Due Date: Specify the deadline by which the payment should be made.

- Invoice Amount: Clearly state the total amount due for the goods or services provided.

- Payment Status: Track the payment status, whether it is pending, partially paid, or paid in full.

Step 2: Organize the Worksheet

Organize the worksheet in a logical and user-friendly manner. Consider grouping invoices by customer or date to make it easier to navigate and locate specific records. Use headings and sub-headings to categorize information effectively.

Step 3: Include Relevant Details

Ensure that the worksheet includes all the necessary details related to each invoice. This includes the invoice number, date, due date, invoice amount, and payment status. You may also add additional fields, such as the product or service description, quantity, and unit price.

Step 4: Regularly Update the Worksheet

To maintain the accuracy of the accounts receivable worksheet, it is crucial to update it regularly. As payments are received, mark them as paid and update the payment status accordingly. This will help you keep track of outstanding balances and ensure timely follow-up with customers.

Step 5: Analyze and Review

Periodically analyze and review your accounts receivable worksheet to gain insights into your business’s financial health. Identify any trends or patterns, such as recurring late payments or customers with outstanding balances. This analysis can help you make informed decisions to improve cash flow and minimize bad debt.

Accounts Receivable Worksheet FAQs

-

What is the purpose of an accounts receivable worksheet?

The purpose of an accounts receivable worksheet is to help businesses track and manage their outstanding customer invoices. It serves as a centralized record of sales transactions, allowing businesses to monitor payment statuses, identify overdue accounts, and maintain a healthy cash flow.

-

How often should I update my accounts receivable worksheet?

It is recommended to update your accounts receivable worksheet on a regular basis, preferably daily or weekly. By keeping the worksheet up-to-date, you can stay on top of your outstanding balances, promptly follow up with customers, and maintain accurate financial records.

-

Can I customize my accounts receivable worksheet template?

Yes, you can customize your accounts receivable worksheet template to suit the specific needs of your business. Tailor the template to include relevant fields and information that align with your invoicing and payment processes.

-

How can I encourage timely payments from customers?

Encouraging timely payments from customers requires clear communication, streamlined invoicing processes, and proactive follow-up. Send invoices promptly, include clear payment instructions, and establish friendly reminders for overdue payments. Offering incentives for early payments, such as discounts, can also motivate customers to settle their invoices promptly.

-

What steps can I take to minimize bad debt?

To minimize bad debt, it is essential to have a robust credit assessment process in place before extending credit to customers. Set credit limits based on their creditworthiness, monitor payment patterns, and establish effective collection procedures for overdue accounts. Regularly review your accounts receivable aging report to identify potential risks and take proactive measures to mitigate them.

-

Are there any software solutions available for managing accounts receivable?

Yes, several software solutions are available for managing accounts receivable efficiently. These software platforms offer features such as automated invoicing, payment reminders, online payment options, and real-time reporting. Consider exploring these options to streamline your accounts receivable processes and enhance efficiency.

Conclusion

In conclusion, an accounts receivable worksheet is an invaluable tool for effective financial management. It enables businesses to track and manage their outstanding customer invoices, maintain a healthy cash flow, and make informed financial decisions. By following the steps outlined in this guide and utilizing an organized and regularly updated accounts receivable worksheet, you can enhance your financial processes and improve the overall stability of your business.

Remember, managing accounts receivable is crucial for long-term success, and an effective worksheet is your key to maintaining financial health. Stay proactive, stay organized, and watch your business thrive!