Cash Control Daily Movement Leave a comment

Ensuring Financial Stability and Transparency

Introduction

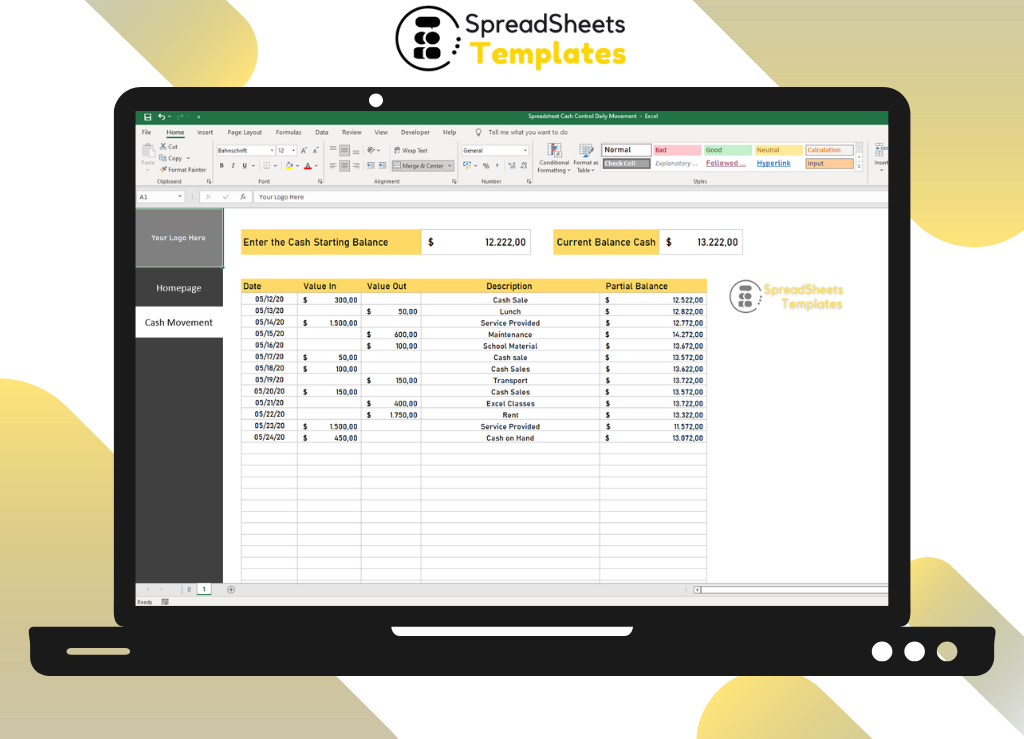

Welcome to our comprehensive guide on cash control daily movement, an essential practice for businesses and organizations to ensure financial stability and transparency. In this article, we will delve into the intricacies of managing cash flow on a daily basis, exploring the importance of maintaining control, best practices, and strategies to optimize your financial operations. Whether you’re a small business owner or a financial professional, understanding cash control daily movement is crucial for success. Let’s dive in!

Cash Control Daily Movement: Understanding the Basics

Cash control daily movement refers to the process of monitoring, tracking, and managing the inflow and outflow of cash within an organization on a daily basis. It involves keeping a close eye on cash transactions, such as sales, expenses, and deposits, to maintain accuracy and prevent financial discrepancies. By implementing effective cash control measures, businesses can mitigate the risk of fraud, identify potential cash flow issues, and ensure proper financial record-keeping.

The Significance of Cash Control Daily Movement

Efficient cash control daily movement is vital for several reasons. Let’s explore its key significance:

1. Financial Stability

Maintaining control over daily cash movements enables businesses to achieve and sustain financial stability. By accurately tracking cash inflows and outflows, organizations can identify any gaps or discrepancies promptly. This helps prevent cash shortages, enables timely bill payments, and facilitates better decision-making based on accurate financial data.

2. Fraud Prevention

Proper cash control measures act as a deterrent to fraudulent activities within an organization. Regular monitoring of cash transactions and implementing internal controls reduces the risk of misappropriation or unauthorized use of funds. This not only protects the business from financial losses but also helps build trust among stakeholders.

3. Budgeting and Forecasting

An effective cash control daily movement process provides valuable insights for budgeting and forecasting purposes. By analyzing historical cash flow data, businesses can make informed decisions regarding future expenditures, investments, and growth strategies. Accurate forecasting helps align financial goals with overall business objectives, contributing to long-term success.

4. Improved Decision-Making

Timely and accurate cash control information empowers decision-makers within an organization. By having a clear understanding of cash flow trends, management can make informed choices related to inventory management, resource allocation, and strategic planning. This enables businesses to optimize operations, minimize risks, and maximize profitability.

Best Practices for Cash Control Daily Movement

To ensure effective cash control daily movement, it is crucial to follow industry best practices. Here are some key recommendations to consider:

1. Segregation of Duties

Implement a system of checks and balances by separating cash handling responsibilities among different individuals or departments. This segregation reduces the risk of errors or fraudulent activities and promotes accountability within the organization.

2. Daily Reconciliation

Regularly reconcile cash balances with financial records to identify any discrepancies promptly. This includes comparing cash sales, deposits, and expenses against the recorded transactions. Any discrepancies should be investigated and resolved immediately.

3. Cash Handling Policies and Procedures

Establish clear and comprehensive policies and procedures for cash handling. This includes guidelines for cash register management, cash counting, and deposit preparation. Regularly review and update these policies to adapt to changing business needs and industry standards.

4. Cash Flow Forecasting

Develop a robust cash flow forecasting system to project future cash inflows and outflows. This enables businesses to anticipate cash shortages or surpluses, plan for contingencies, and make informed financial decisions.

5. Regular Auditing

Conduct periodic internal and external audits to ensure compliance with cash control policies and identify areas for improvement. Audits help detect any weaknesses or vulnerabilities in the cash control process and provide recommendations for enhancement.

FAQs About Cash Control Daily Movement

- What are the primary objectives of cash control daily movement?

- The primary objectives of cash control daily movement are to maintain financial stability, prevent fraud, support budgeting and forecasting, and improve decision-making within an organization.

- How can businesses improve cash control daily movement?

- Businesses can improve cash control daily movement by implementing segregation of duties, conducting daily reconciliations, establishing cash handling policies and procedures, implementing cash flow forecasting, and conducting regular audits.

- What are the risks of poor cash control?

- Poor cash control can lead to financial discrepancies, cash shortages, increased fraud risk, inaccurate budgeting and forecasting, and impaired decision-making. It can also negatively impact the overall financial stability and reputation of a business.

- Why is segregation of duties important in cash control?

- Segregation of duties ensures that no single individual has complete control over cash handling processes. It reduces the risk of errors, misappropriation, or fraudulent activities by requiring multiple individuals to be involved in the cash control process.

- What is the role of technology in cash control daily movement?

- Technology plays a crucial role in cash control daily movement by automating cash handling processes, providing real-time financial data, facilitating cash flow forecasting, and enhancing security through advanced encryption and authentication measures.

- How often should businesses conduct cash flow forecasting?

- The frequency of cash flow forecasting may vary depending on the business’s size, industry, and cash flow volatility. However, it is recommended to conduct cash flow forecasting on a monthly basis, with more frequent assessments during periods of significant cash flow changes.

Conclusion

In conclusion, cash control daily movement is a critical practice for businesses and organizations to ensure financial stability, transparency, and informed decision-making. By implementing effective cash control measures and following industry best practices, businesses can mitigate risks, prevent fraud, and optimize their financial operations. Regular monitoring, segregation of duties, and accurate cash flow forecasting are key components of a robust cash control system. Remember, a well-managed cash flow is the foundation for a successful and thriving business.