Trial Balance Template Leave a comment

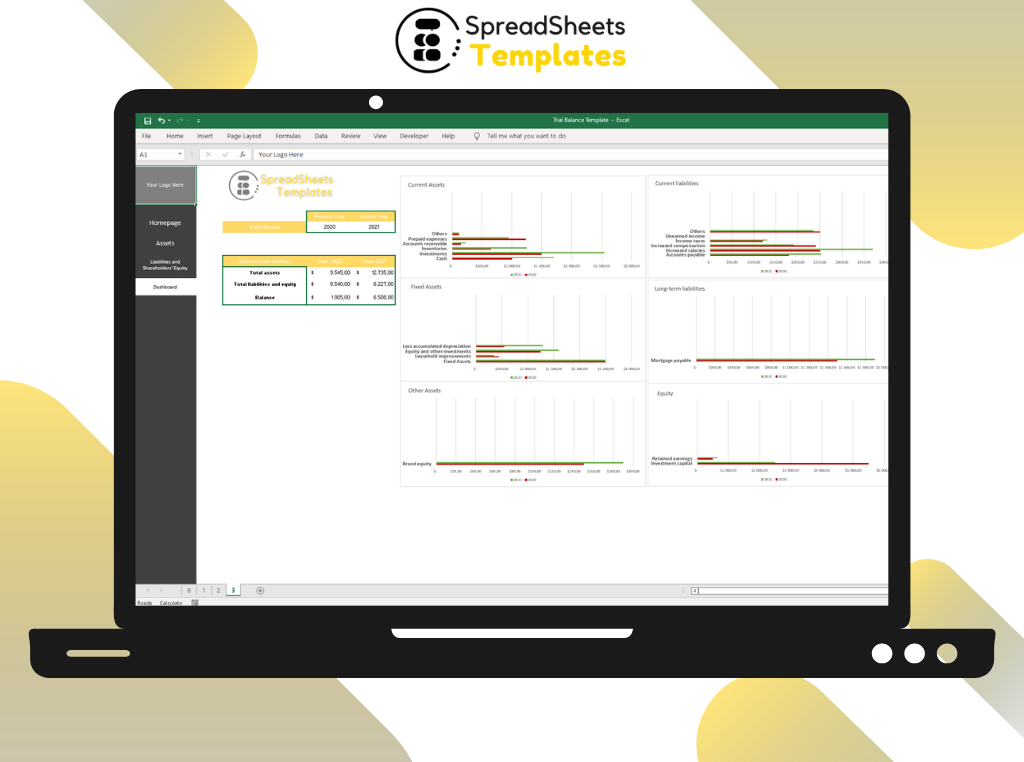

Streamline Your Financial Reporting

Introduction

In the world of accounting, maintaining accurate and organized financial records is crucial. One essential tool that accountants use is the trial balance. A trial balance acts as a snapshot of a company’s financial position by listing all the accounts and their respective balances. To simplify the process of creating a trial balance, many professionals turn to trial balance templates. In this article, we will explore the benefits of using a trial balance template and provide you with valuable insights into how it can streamline your financial reporting.

The Importance of Trial Balance Template

What is a Trial Balance Template?

A trial balance template is a pre-designed document that helps accountants organize and present financial data efficiently. It provides a structured format for listing all the accounts and their corresponding balances. By utilizing a trial balance template, businesses can ensure accuracy and save valuable time during the financial reporting process.

Benefits of Using a Trial Balance Template

- Saves Time: Manual creation of a trial balance can be a time-consuming process. With a trial balance template, you can quickly input the account balances and let the template automatically calculate the total debits and credits.

- Accuracy: Trial balance templates eliminate the chances of human error during calculations. The built-in formulas and functions in the template ensure accurate calculations, reducing the risk of errors in financial reports.

- Easy Organization: A trial balance template provides a systematic layout for organizing financial information. It categorizes accounts into their respective groups, making it easier to analyze and review balances.

- Consistency: Trial balance templates promote consistency in financial reporting. By using the same template for each accounting period, you ensure uniformity and make it easier to compare data across periods.

- Streamlined Analysis: The structured format of a trial balance template allows for easier analysis of financial data. You can quickly identify any imbalances or discrepancies and take appropriate corrective actions.

Trial Balance Template: How to Use It

Step 1: Downloading a Trial Balance Template

To get started, download a trial balance template from a reputable source. You can find a variety of templates available online, including free options and premium templates with advanced features.

Step 2: Customizing the Template

Once you have downloaded the trial balance template, it’s time to customize it to fit your specific needs. Add your company’s name, logo, and other relevant details to make it personalized and professional.

Step 3: Inputting Account Balances

The trial balance template will consist of columns for account names, debits, and credits. Input the balances from your general ledger into the appropriate columns. The template will automatically calculate the total debits and credits.

Step 4: Verifying the Trial Balance

After inputting all the account balances, it’s essential to verify the trial balance. The total debits and credits should match, ensuring that the accounts are in balance. If there are discrepancies, double-check the entries and make any necessary adjustments.

Step 5: Analyzing the Trial Balance

Once you have a balanced trial balance, it’s time to analyze the data. Look for any significant fluctuations or irregularities in the account balances. This analysis can provide valuable insights into your company’s financial health and help identify areas that require attention.

FAQs about Trial Balance Templates

Q1: Can I modify the trial balance template to suit my company’s chart of accounts?

Yes, trial balance templates can be customized to align with your company’s specific chart of accounts. You can add or remove account categories, rearrange the order, and tailor the template to fit your requirements.

Q2: Are trial balance templates suitable for small businesses?

Absolutely! Trial balance templates are beneficial for businesses of all sizes. They simplify the financial reporting process and provide a clear overview of your company’s financial position, regardless of its scale.

Q3: Can I use a trial balance template in spreadsheet software like Microsoft Excel?

Yes, trial balance templates are commonly available in spreadsheet formats like Microsoft Excel. These templates often come with built-in formulas and functions, making it easier to input data and perform calculations.

Q4: Are trial balance templates compatible with accounting software?

Many accounting software programs offer trial balance templates as part of their features. These templates can integrate seamlessly with the software, allowing for direct import or export of data, further streamlining the financial reporting process.

Q5: Can I share the trial balance template with my team members?

Yes, trial balance templates can be shared with team members involved in the financial reporting process. This collaborative approach enhances efficiency and ensures consistent reporting practices within the organization.

Q6: Where can I find reliable trial balance templates?

You can find reliable trial balance templates on various websites, including accounting software providers, financial resource platforms, and business template repositories. Be sure to choose a template from a reputable source to ensure its accuracy and functionality.

Conclusion

In conclusion, utilizing a trial balance template can greatly simplify and streamline your financial reporting process. By saving time, ensuring accuracy, and providing a structured format for data organization, trial balance templates enhance the efficiency and reliability of your financial reports. Whether you are a small business owner or a seasoned accountant, incorporating a trial balance template into your workflow can contribute to improved financial analysis and decision-making.

Don’t let the complexities of financial reporting overwhelm you. Embrace the power of trial balance templates and take control of your company’s financial data. Start using a trial balance template today and experience the convenience and accuracy it brings to your financial reporting endeavors.